Leafy green production in “The Winter Salad Bowl” in Yuma, AZ, is drawing to a close as growers transition back to the Salinas Valley in California. Yuma, also known as America’s winter lettuce capital, produces just under 90% of the lettuce, citrus, and many other vegetables for the United States every winter.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

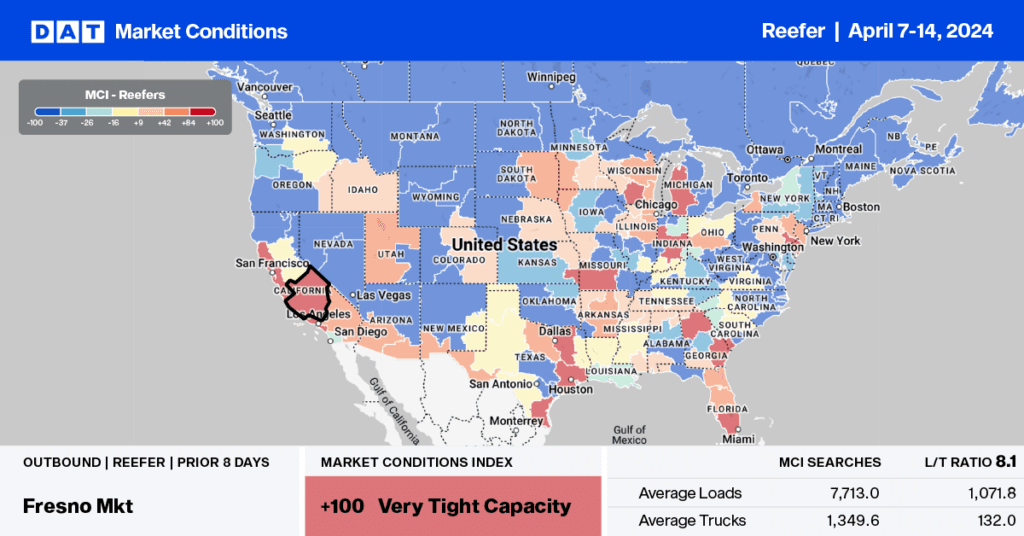

The latest data from the USDA indicated shipments of lettuce in Yuma, AZ, were down 23% y/y at the end of March, totaling 23,272 truckloads. As the leafy green season in the Imperial Valley ends, growers begin to shift operations from Yuma back to the Salinas Valley just south of San Francisco. Growers like Church Brothers Farms will move their entire salad plant between the two locations, involving over 200 people and 60 flatbed trucks twice yearly. For reefer carriers, this means a shift in production volumes of leafy greens back to the Central and Salinas Valley until Winter rolls around again.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

As produce volumes decrease in Yuma, AZ, during the transition back to Salinas for leafy green production, spot rates out of Yuma, AZ, to all major markets decrease. Average reefer rates in the Phoenix market decreased by $0.03/mile m/m to an average outbound rate of $2.24/mile last week on a 46% lower volume of loads moved in the last month. Yuma to Los Angeles loads paid carriers an average of $2.52/mile last week, $0.10/mile lower than the March average but almost identical to last year.

In Salinas, CA, known as the Summer Salad Bowl, outbound loads moved increased by 22% in the San Franciso market last week as the regional produce seasons started to ramp up. Salinas to Chicago loads paid carriers $1.62/mile, almost $0.10/mile higher than last month’s average and this time last year. Cross-country loads to Hunts Point, NY, are $0.03/mile higher y/y, averaging $1.71/mile.

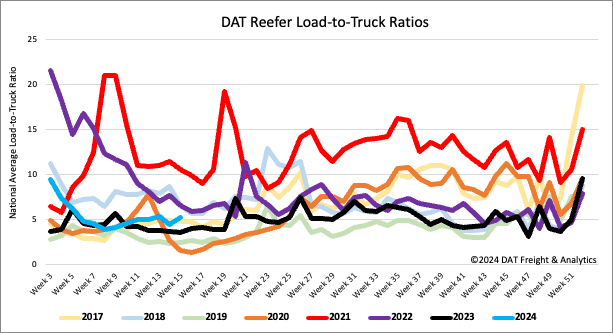

Load-to-Truck Ratio

Reefer load post volume increased by 8% last week but remains 5% lower than last year and 13% lower over the last month. Available capacity decreased following last week’s 7% drop in equipment posts, increasing the load-to-truck ratio by 16% to 5.18.

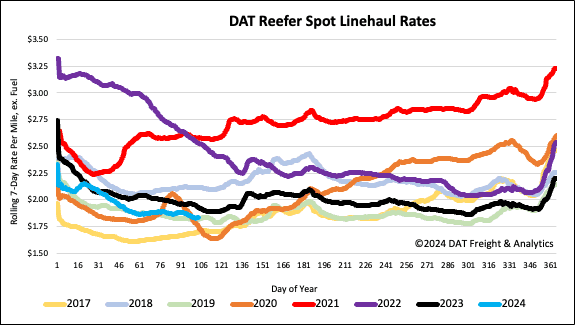

Spot rates

After being flat for the prior two weeks, reefer spot rates dropped a penny per mile last week to a national average of $1.86/mile. Reefer linehaul rates are $0.9/mile lower and $0.01/mile higher than in 2019.