Reefer carriers finally got some good news last week. Demand for refrigerated trailers has been relatively soft this year, but shipments ahead of Memorial Day weekend pushed rates higher in many major markets and high-traffic lanes. That should also help van rates, since reefer carriers often compete for dry van loads when reefer demand is low.

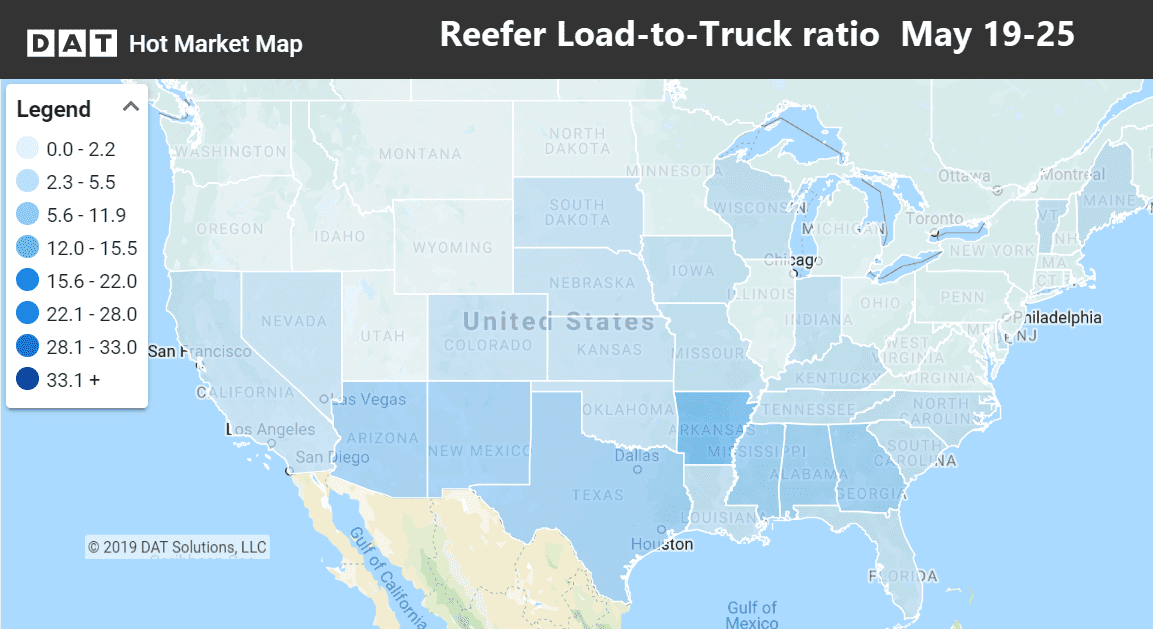

Last week the load-to-truck ratio was up 12% over the previous week, and the national average reefer rate for May is now at $2.16 per mile — 1¢ higher than the April average. Rates are expected to rise higher in the next few weeks.

The national average load-to-truck ratio for reefers increased to 2.9 loads per truck last week.

Rising rates

Reefer rates out of California typically peak in June, and that upward trend started last week. Potato harvests also helped push prices higher out of Green Bay and Grand Rapids, while volumes increased in Southern Idaho.

- Green Bay to Chicago rose 28¢ to $3.28/mi.

- Sacramento to Salt Lake City jumped 39¢ to $2.62/mi.

- Fresno to Denver added 18¢ to $2.27/mi.

- Atlanta to Chicago increased 25¢ to 2.11/mi.

- Miami to Baltimore was also up 24¢ to 2.54/mi.

Falling rates

There were relatively few declining lanes, and most drops were slight.

- Atlanta to Miami fell 15¢ to $2.25/mi.

- And the return trip from Miami back to Atlanta was also down 15¢ to $1.91/mi.

- Ontario, CA to Chicago dipped 10¢ to $2.02/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.