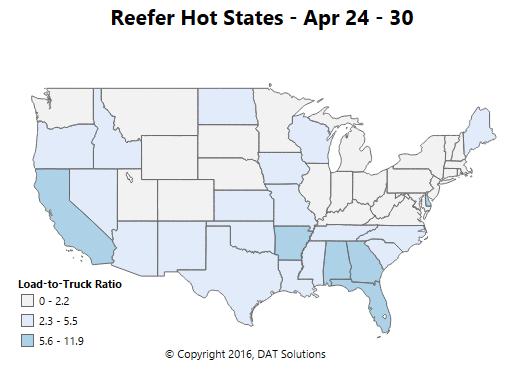

Reefer volumes rebounded in a big way last week, thanks to early harvests in California and late produce shipments from Florida. Other top states for produce are Texas and Georgia, and rates are trending up in the southern parts of both states.

The darker states above have higher load-to-truck ratios, meaning there’s less competition for freight in those states.

All rates include fuel surcharges and are based on actual transactions between carriers and brokers.

SOUTHEAST

The Southeast continues as the best region to find reefer freight. Miami is the top market for reefer load posts on DAT Load Boards right now. Lakeland in Central Florida is number 3. Rates are soaring on outbound lanes that connect those two markets to distribution centers in Atlanta, in the Northeast and in the Midwest.

- Miami to Elizabeth, NJ, spiked 42¢ and paid $2.19/mile on average

- Miami to Atlanta paid 38¢ better at $1.79/mile

- Lakeland to Atlanta rose 51¢ to $1.72/mile

- Lakeland to Chicago was up 30¢ to $1.54/mile

WEST

Reefer prices held steady in Los Angeles. Prices dipped in Ontario, CA, but they could rebound again this week.

- Sacramento to Denver came crashing, down 37¢ to an average of $2.05/mile — about where it was a couple weeks ago

- Volume was way up in Twin Falls, ID, and the average outbound rate added 6¢

SOUTH CENTRAL

Growth was slower in McAllen, TX, than in other big reefer markets. The lane from McAllen to Atlanta is now competing with Florida produce, and last week Florida won. The average rate out of McAllen dropped 18¢ to $1.81/mile. Dallas is still in the top 5 for reefer load posts on DAT Load Boards, and the average outbound rate there edged up 3¢.

NORTHEAST

Even though most reefer activity has shifted to the south, an end-of-month surge out of Philly boosted rates up 5¢ to an outbound average of $2.18/mile.

MIDWEST

Green Bay was the only major reefer market last week to show a decline in load volume. Chicago was still relatively quiet, and the average outbound rate dipped 1¢ to $1.91/mile.

See where demand for reefers is highest with Hot Market Maps in DAT Power™. See the average rates paid to carriers on more than 65,000 lanes with DAT RateView™. Call 800.551.8847 or email us for more info.https://www.dat.com/carriers