Many industries are struggling to keep up with the speed of the economy’s reopening, including the American steel industry.

Just over a year ago many steel manufacturers were forced to shut down production. But as the economic recovery got underway, steel mills — like many others in manufacturing — were slow to resume production leading to the current situation where demand far outstrips capacity.

For the week ending May 29, 2021, domestic raw steel production was 1,836,000 net tons compared to 1,223,000 net tons for the same week in 2020, a 50.1% increase. In truckload terms, that’s the equivalent of just over 73,000 truckloads or 24,500 more truckloads this year.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Steel production is up 9.5% since the beginning of the year as steel mills reach a capacity utilization rate of 78.1% compared to just 69.9% during the same period last year. For flatbed and specialized carriers, the 14% increase in domestic capacity utilization is good news and a sign that steel mills are ramping up production as fast as they can.

On the import front, net tonnage imported from overseas was up 5.1% this year for the first four months of 2021. Ingots, billets and slabs account for 37% of imported tonnage in April. This is followed by hot rolled sheets of steel at 8.5%. That’s a volume increase of 60.5% since the beginning of the year and 42.2% year-over-year respectively.

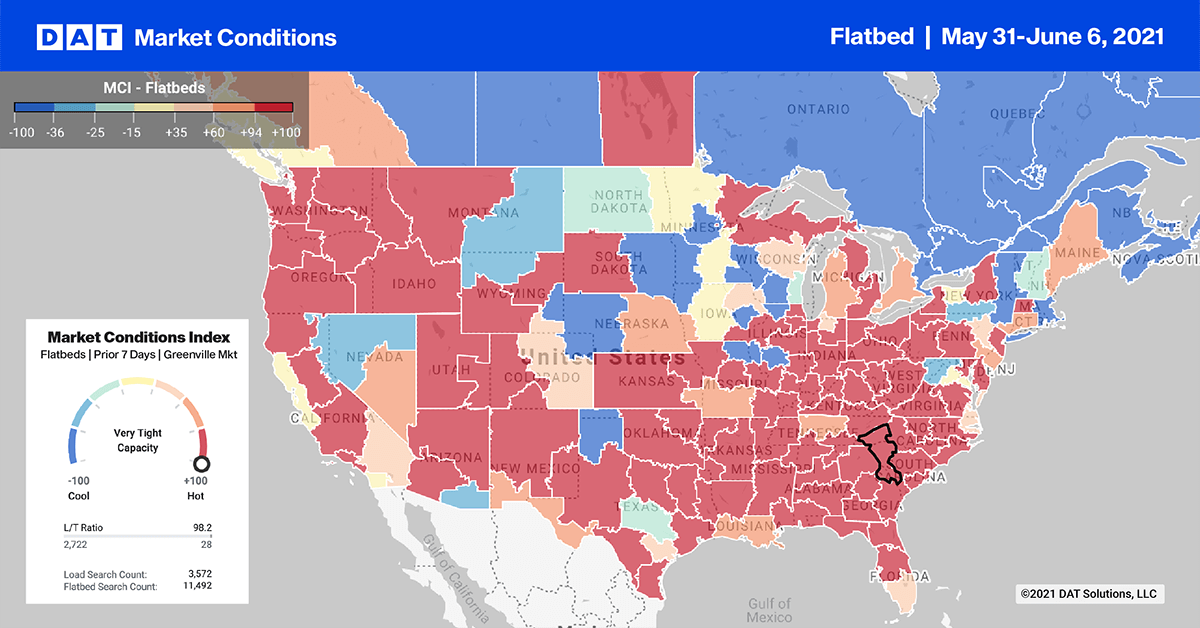

Flatbed capacity in the top 10 markets doesn’t appear to be easing even though national spot market load volumes decreased for the fifth week in a row.

Top 10 market volumes were predictably down last week by 13% in a shorter and post-long weekend work week. However, spot rates continued to climb, increasing by an average of $0.08/mile to reach a record-high $3.72/mile.

Capacity was noticeably tighter in Memphis where rates jumped $0.16/mile to reach $3.83/mile last week. In the second largest flatbed spot market in Houston, there was no change in capacity last week with spot rates staying at $2.87/mile.

Spot rates

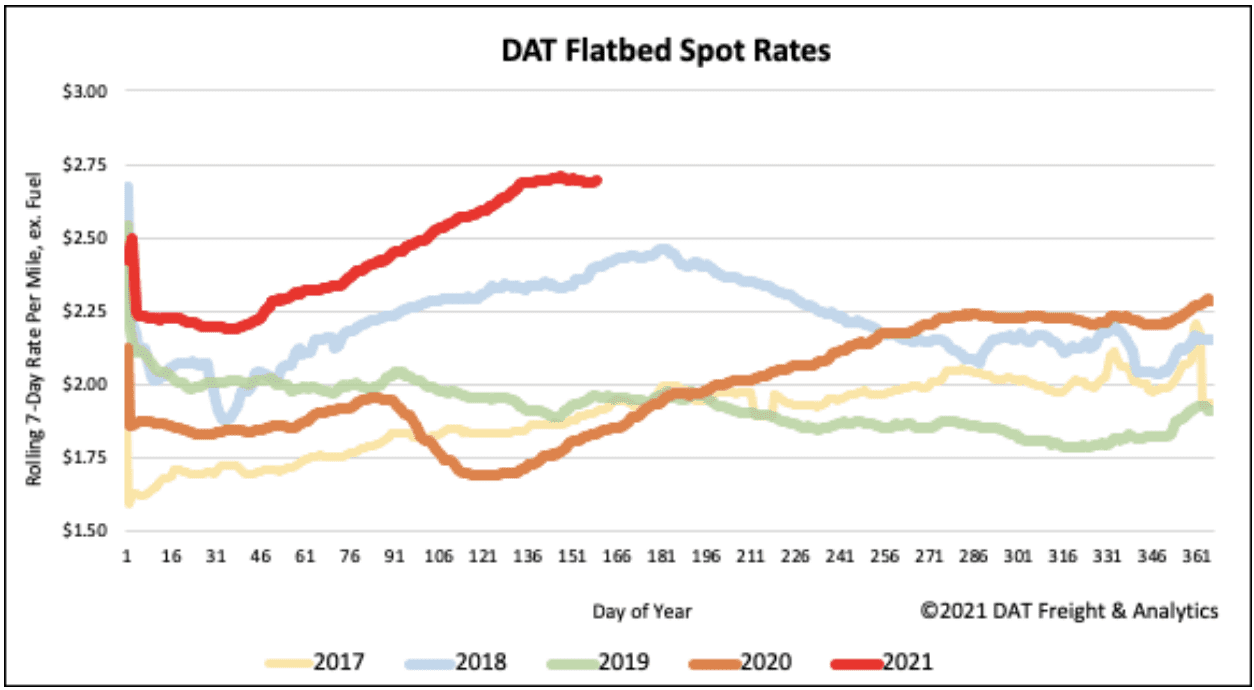

Flatbed spot rates are definitely plateauing around the $2.69/mile following last week’s less than $0.01/mile decrease in spot rates. Flatbed rates are still $0.87/mile higher than the same week last year and $0.30/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models