Last week, two data points and one jaw-dropping chart suggested that there’s still no end in sight to the ongoing restocking of inventories that have been depleted due to COVID-10. The big question: If inventories are already depleted and warehouse capacity is contracting, where do we put all of this freight?

The first data point came from the Logistics Managers Index (LMI). The February reading indicated that the logistics industry continued to expand through the beginning of 2021, with the index up 4.2 points month over month and nearly 19 points above February 2020.

“On top of the increased demand that came from clogged ports and the increased growth rate for e-commerce due to the pandemic, it is likely to lead to a continued crunch on available logistics capacity,” noted Zac Rogers, Assistant Professor at Colorado State University. “This poses a challenge, as demand for logistics capital like trucks, ships and warehouses increased two to three times faster than expected in 2020, leaving supply chains at a deficit with demand far outstripping available supply.”

The LMI Warehousing Capacity Index was down for the sixth consecutive month, 18.4 points down from February 2020. Warehouse capacity contracted at a paced that’s now increased three months in a row.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The second data point came from Jason Miller, Supply Chain Economist and Associate Professor at Michigan State University, who offered analysis of retail inventories and sales data from the U.S. Census Bureau.

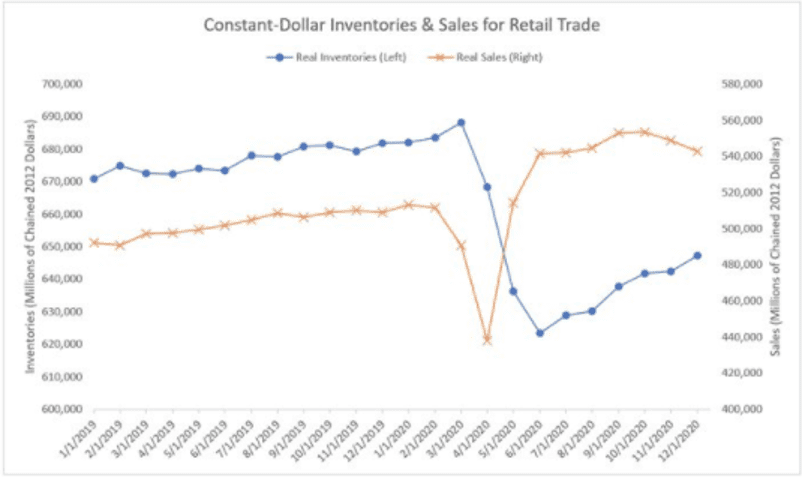

Retail inventory levels had a shortfall of close to $40 billion for the year ending December 2020 compared to December 2019.

In the chart above, sales (orange line) were up 6.6% year over year, but inventories (blue line) were down 5.1%, which indicates there is still a lot of restocking to be done.

To translate the inventory shortfall into truckload shipments, Professor Miller used an average of $3,500 per ton of value for mixed freight shipments and 15 tons per truckload shipment. He concluded that just over 656,000 truckload shipments are required to bring inventory back to 2019 levels.

“It’s going to take months to build back these retail inventory levels,” said Miller. “This assumes consumption stays flat, but if it accelerates, inventory replenishment becomes even more challenging because freight is going out the door as quickly as it’s coming in.”