One of the more challenging questions industry economists are grappling with is the degree to which consumer spending shifts away from physical goods (that trucks transport) to services in coming months. The most recent report from Institute for Supply Management (ISM) indicated a surge in pent-up consumer demand as more sectors of the economy open.

According to Anthony Nieves, Chair ISM Business Survey Committee, the Services PMI (Purchasing Managers Index) registered an all-time high of 63.7%, which was 8.4% higher than the February reading of 55.3%.

“The March reading indicates the 10th straight month of growth for the services sector, which has expanded for all but two of the last 134 months,” says Nieves.

The manufacturing sector also saw an ISM index increase for the 10th month in a row following sharp market contractions last April. The ISM index increased by 3.9% to 64.7% in March. For carriers looking to the ISM as a reliable indicator of future demand, this month’s report suggests the manufacturing sector will face strong headwinds despite the optimism about the overall economic recovery.

Manufacturers continue to be impacted by limited parts availability and resulting short-term plant shutdowns, employee absenteeism and difficulty filling open positions. However, the report noted that the following — and largest — manufacturing industries registered strong growth in March:

- Computer & Electronic Products

- Fabricated Metal Products

- Food, Beverage & Tobacco Products

- Transportation Equipment

- Chemical Products

- Petroleum & Coal Products

Find loads and trucks on the largest load board network in North America.

All rates exclude fuel unless otherwise noted.

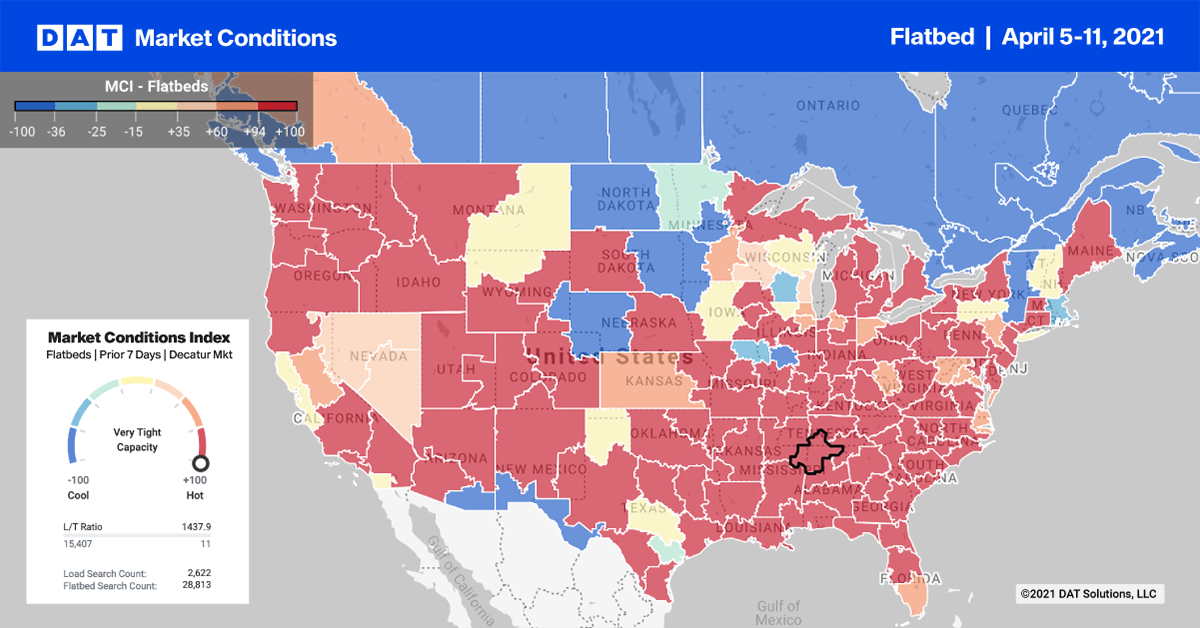

Flatbed load post volumes in the top 10 markets increased by 1% with spot rates decreasing by $0.02/mile to an average of $3.24/mile last week (excluding fuel). However, last week’s average hides some wild fluctuations in spot rates, volumes and capacity.

- Decatur, AL: Volumes dropped 7%, and rates plummeted by $0.50/mile to $4.13/mile

- Charlotte: Volumes dropped 31%, and rates increased by $0.20/mile to $3.31/mile.

- Memphis: Volumes increased by 20% and capacity tightened slightly to push spot rates up by $0.02/mile to $3.35/mile