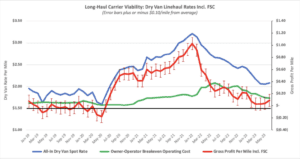

Owner-operator and small fleet profitability defied all odds and improved in June due to rising spot rates and falling diesel prices. After several months of teetering on the edge of a 2019 repeat (when the trucking industry saw record numbers of bankruptcies), long-haul carriers breathed a sigh of relief last month. It could be short-lived, but most small carriers now have a little more breathing room as we begin the year’s second half.

DAT Freight & Analytics has been focusing closely on the viability of the spot market carrier, a leading indicator of market cycle timing. The spot market currently represents around 15% to 17% of truckload volume and typically leads to changes in contract rates by four to six months. Assuming past freight market cycle timing holds, we believe that spot rates are close to or have bottomed out. Therefore, contract rates should reverse course and start to increase in the Fall.

Spot market dredges along the bottom

The current market has shown very soft demand; therefore, small changes in capacity levels in the spot market can significantly impact spot rates in the short-term and contract rates further down the road. Dry van spot rates have been dredging along the bottom for a few weeks now and, at some point in the short-term, will converge with falling contract rates on a year-over-year percentage change basis. When this occurs, we expect the current market cycle to begin a recovery phase. In nominal terms, the spread between contract and spot rates is narrowing; the spread was $0.60/mile three months ago, and was around $0.50/mile at the start of July.

Small fleet owners and owner-operators in the spot market started the second quarter perilously close to 2019 profitability levels (which averaged -$0.02/mile). In April, long-haul spot market carriers were making just $0.03/mile gross profit after all expenses, but as diesel dropped and spot rates bottomed out in May, profitability improved to $0.04/mile (see Figure 1). Produce season, Roadcheck Week, Memorial Day, and July 4 celebrations provided much-needed boosts for carriers. Spot rates improved to an average of $2.08/mile (including FSC), and as diesel continued to fall (to $3.77/gal), carrier profitability improved to $0.09/mile. The big question is whether this trend will continue. So long as diesel continues to decrease and rates remain flat, the answer is yes. But that could be a stretch goal as we head further into summer when linehaul rates typically cool off.

Long-haul carrier sentiment remains negative

A gross profit of $0.09/mile is insufficient to sustain long-term trucking viability, but carriers can barely get by at that level. In pessimistic terms, carriers are a major breakdown away from going out of business. For a small carrier to remain profitable over the long term, the gross profit margin must be closer to $0.30/mile. To achieve that level of profitability, spot rates need to be around $2.70/mile, including FSC – if diesel prices stay at the same level they are today.

In June, more long-haul interstate carriers left the industry than joined, slightly improving May’s total. For now, although this sector is still losing capacity, it is at a decreasing rate that’s insufficient to cause the spot market to make a significant correction. Suppose small carrier viability continues to improve and the rate of capacity exiting the industry slows. In that case, we should be prepared for another two to three months of tepid market conditions before the next market cycle emerges in the Fall.

*Assumes 100,000 loaded miles, 15,000 empty miles, 6.5mpg, financed truck and trailer, EIA national average diesel prices, and $63,000/year driver wages.