As we move into the fall, the truckload market is still seeing record-high spot rates. Total volumes were only up 1.6% in September compared to September 2019, but network imbalances continue to push shipments into the spot market and place pressure on pricing.

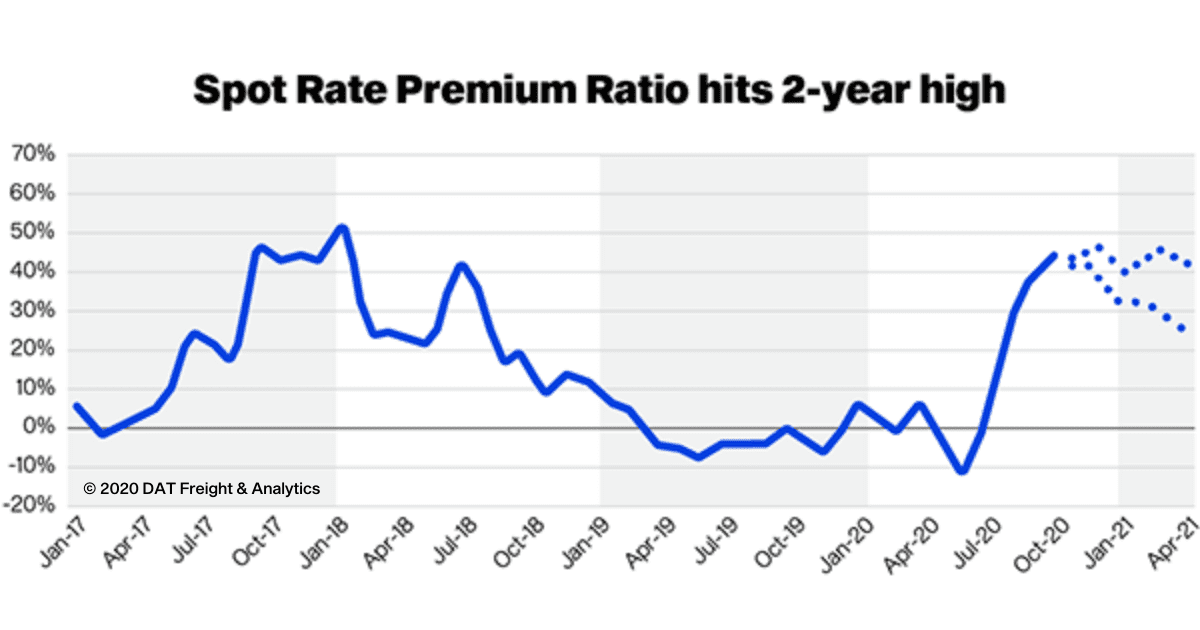

You can see that trend reflected in the Spot Premium Ratio (SPR), a measurement from DAT iQ that calculates the Average Spot Rate Cost per Mile divided by the Average Contract Rate Cost per Mile, capturing the pressure that spot rates are placing on contract rates.

Learn more about the SPR in this month’s Pulse Signal Report from DAT iQ.

It’s not all doom and gloom for shippers, though – there are signs that markets are cooling down.

Get this month’s Pulse Signal Report from DAT iQ to see how much pressure the spot market is placing on contract prices, and when that pressure will start to ease.

The Pulse Signal Report is sent monthly to a group of leading shippers who rely on DAT iQ to benchmark their transportation costs and operations with relevant data and insights, with a clear 360-view of the truckload marketplace.

More benefits:

- Custom reporting and intelligence

- State-of-the-art analytics and technology

- Peer-to-peer networking

Learn more about the products and services offered by DAT iQ.