The transportation logistics industry is no stranger to uncertainty. With seasonality shifts, demand fluctuations, rate volatility, and severe inclement weather, organizations have a wide range of variables to consider when designing their operational models. And while these variables are oftentimes outside of their control, what can be controlled is how prepared shippers respond to them.

Enter the integrated adoption of data analytics. By embracing the value of real-time analytical insights across the end-to-end T&L supply chain, organizations can develop the flexibility they need to navigate uncertainty – removing anecdotal guesswork from forecasting and planning processes to drive revenue with data-driven decision making.

In this second edition of The Shipping iQ – DAT iQ’s new series highlighting common industry problems and the solutions available – we tackle the best ways to enhance forecasting and planning and highlight how DAT’s solutions can optimize the way you strategize.

How data analytics bolsters forecasting and planning

Data analytics is a critical tool that shippers can leverage to build healthier transportation networks, increase customer satisfaction, and boost efficiency and profitability for their organization and carrier partners. Further, without data analytics, shippers often struggle with negative outcomes like poor routing guide planning that results in costly leakage, disorganized and inefficient strategic plans, and friction between internal teams if actuals vary significantly from projections.

There are four processes where data analytics should be implemented to help shippers plan successfully: procurement, budgeting, surge pricing, and carrier relations.

Procurement

The procurement process is the first necessary area to implement data analytics. Since transportation procurement is becoming increasingly continuous, data analytics allows shippers to quickly identify and implement rates that will be resilient through the full term of contracts.

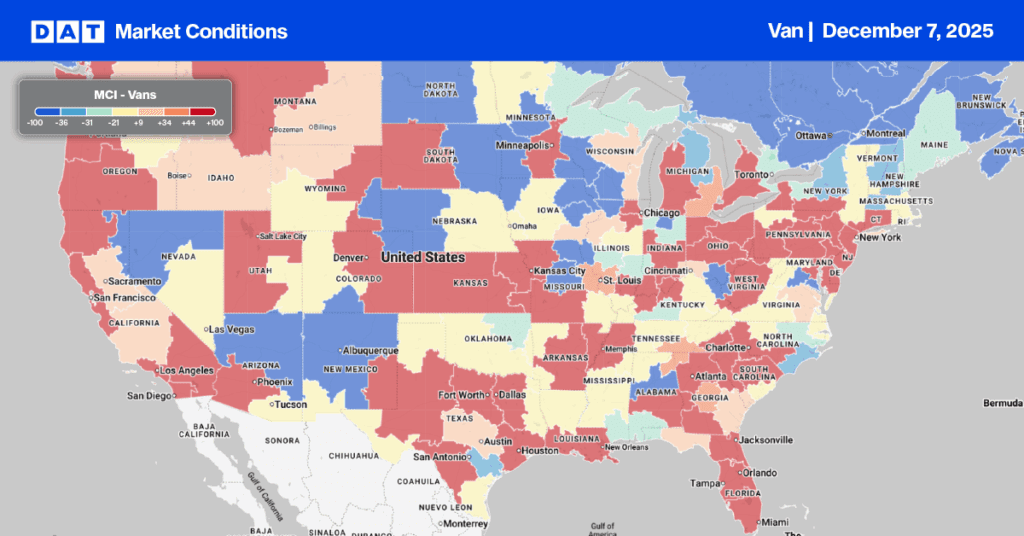

Benchmark data provides contextual insights that can help establish realistic pricing targets based on current market trends and validate subsequent bids from carriers to ensure accuracy, ultimately streamlining the entire negotiation lifecycle.

Additionally, shippers should look to combine rate predictions from current data with historical rate analysis. This helps generate a clear lens into what they’ve historically paid carriers compared to current market benchmarks on a lane by lane basis.

Budgeting

Second, shippers that utilize data analytics are able to build flexibility into their budgets to better manage economic volatility. Leveraging historical data in tandem with forecasting insights allows for broader visibility into potential ebbs and flows in their overall network and for specific lanes, enabling more reliable cost projections and budgeting.

For example, suppose a shipper’s annual budget is based on a 10% spot and 90% contract freight mix. By tapping into the direct correlations between current real-time data analytics and historical analysis, they may identify a high tender rejection rate and a significant number of loads going to the spot market. In turn, the shipper can then adjust their budget accordingly for a more accurate contract mix.

Surge pricing

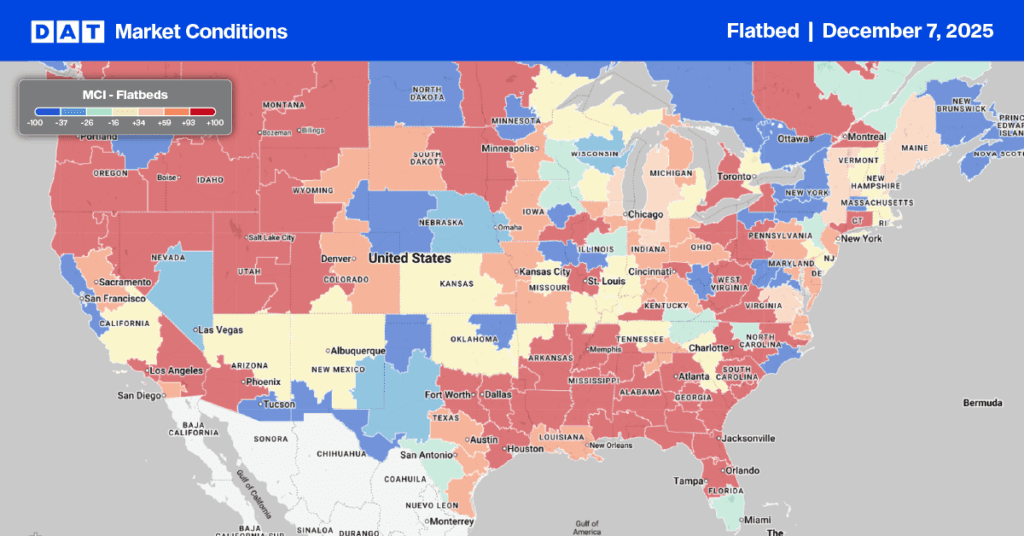

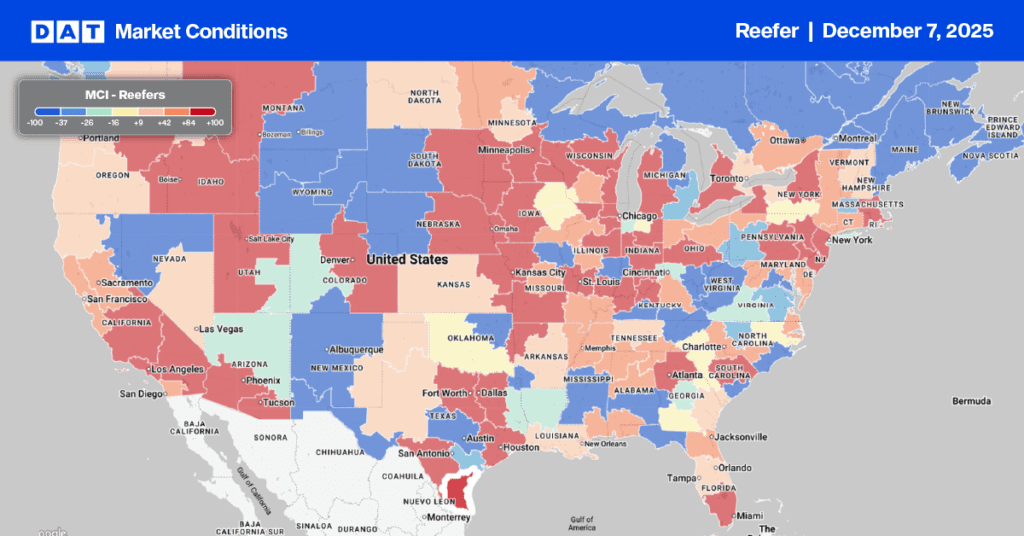

Third, shippers should look to implement data analytics as a means to protect themselves against surge pricing when demand outpaces supply. By leveraging these insights, shippers are more equipped to anticipate seasonal changes in the market and can also react quicker when something unpredictable happens, like severe weather.

For example, the spring produce season typically creates a surge in demand from mid-April through early July. By conducting historical analysis with data analytics tools, shippers can better identify when and where the market will likely see a surge in freight volumes and pricing, and then drill down to see how and when surges will impact their own networks.

Assessing fluctuations between real-time analytics and historical analysis empowers shippers to forecast surges more accurately and structure their budgets within a framework that maximizes efficiency and reduces cost risk.

Carrier relations

Lastly, data analytics can help strengthen shipper-carrier relationships as it increases transparency in the negotiation process to ultimately benefit both parties. When these relationships are thriving and consistent, it’s easier to plan effective budgets and pivot when unforeseen obstacles like a hurricane or snowstorm arise.

Both shippers and carriers should do their part to establish and maintain long-lasting partnerships. Rate analytics and forecasting allows shippers to see if the rates they are paying carriers — or the rates they are receiving from bids — are aligned with the market. More importantly, they can determine if market rates will hold up during the full term of the contract.

The power of DAT to help forecast and plan

Forecasting and planning are critical for shippers to boost efficiency, profitability, and build stronger networks. As such, data analytics should be a key component of any shipper’s overarching strategy.

Transportation analytics from DAT iQ provide the most accurate, relevant, and timely insights for shippers to optimize their forecasting and planning. With an extensive depth and breadth of data, enhanced timing elements, excellent quality control, and top tier linehaul isolation, DAT iQ allows shippers to negotiate long-term contracts, create realistic transportation budgets, effectively manage through surge periods, and strengthen carrier relationships.

Powered by data from more than $150 billion in transactions annually and market insights across all lanes, DAT iQ’s rate analytics tools are intended to equip shippers with the most accurate insights into past, present, and future freight rates, allow shippers to align bids from carriers with market trends, establish resilient pricing, and set realistic transportation budgets.

To learn more, connect with one of our experts and get started on your journey towards improving your forecasting and planning.