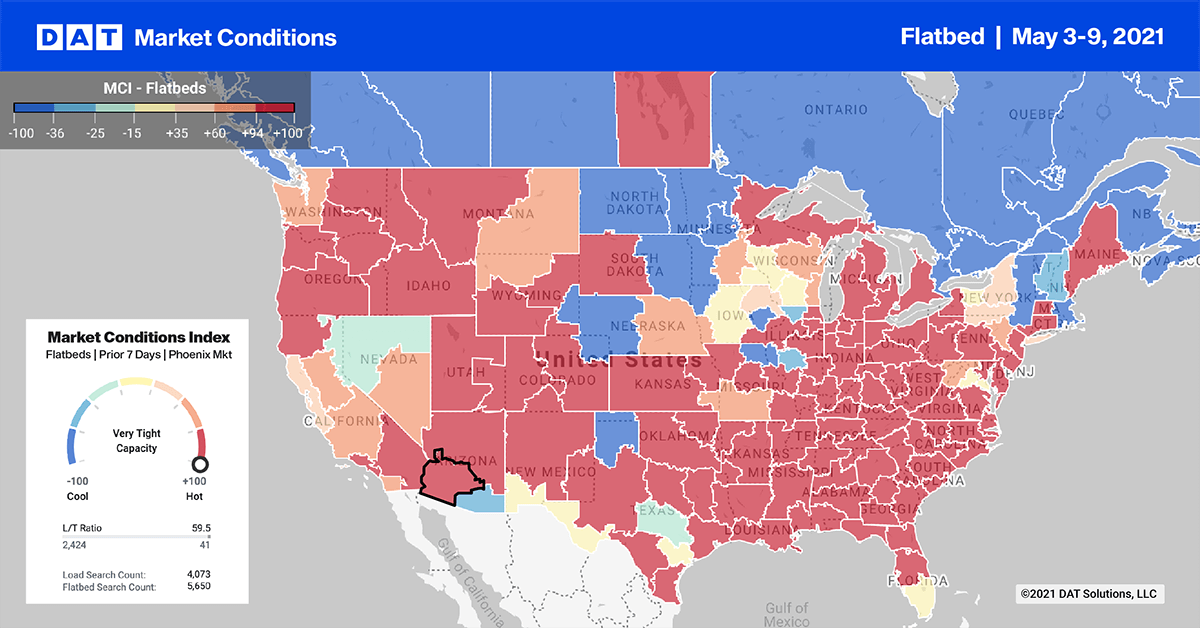

Flatbed average rates in the Top 10 markets increased by $0.12/mile last week, but there were some wild fluctuations rates within the average, as has been the case this year.

In Memphis, volumes were down 4% this week but spot rates were up $0.11/mile to $3.55/mile (not including fuel). Houston had a 12% drop in weekly volume, which also resulted in a rate hike of $0.17/mile to $2.70/mile.

Find loads and trucks on the largest load board network in North America.

In contrast, volumes in Montgomery, AL, were down 9% this week, but capacity was extremely tight driving up rates by $0.70/mile to an average of $4.85/mile. Loads on the 161-mile haul to Atlanta are currently averaging $6.22/mile, which is well into round-trip rate territory. Even rates from Atlanta (#16) back to Montgomery are averaging $4.67/mile this week.

Spot rates

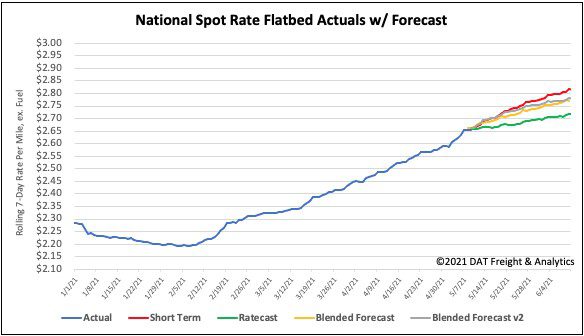

Unlike the other two equipment types where rates spiked last week, flatbed spot rates only increased by $0.05/mile in comparison. They ended the week at $2.67/mile, which is still $0.33/mile higher than the same week last year and $0.20/mile higher than the same time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models