The coronavirus pandemic upended notions of normality in most facets of life in 2020, and the trucking industry was no different.

The complications COVID-19 created for supply chains could be felt across all aspects of life in 2020, whether you were in the freight industry or shopping for groceries in a store with bare shelves. The public at large became much more aware of the types of problems that trucking and logistics professionals have been solving for decades

The pandemic led to an explosion of spot market activity in 2020. In a normal year, roughly 12-15 percent of all truckload shipments were spot loads ┈ transactional shipments arranged outside of a shipper’s normal long-term contracts. When disruptions interrupt the normal freight flows within supply chains, shippers and brokers turn to the spot market for flexibility. In 2020, up to 23 percent of all truckloads were spot shipments

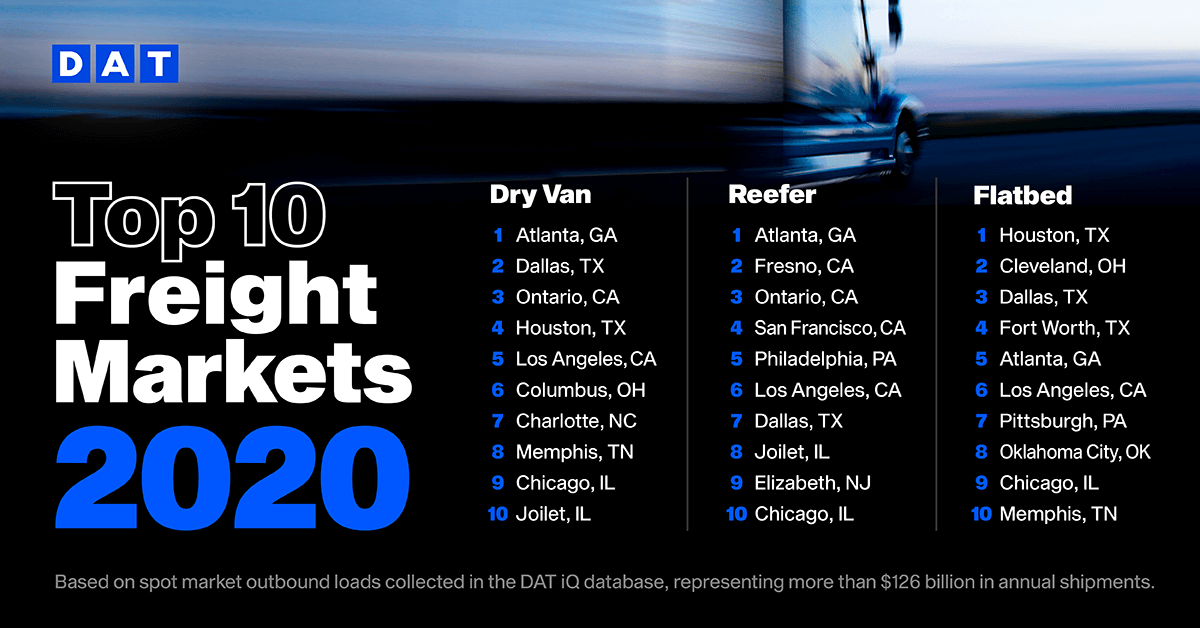

Below are the top 10 markets with the most outbound dry van, refrigerated and flatbed long haul loads on the spot market in 2020.

Find freight and trucks with DAT One and the largest on-demand freight marketplace in North America.

Calculated based on spot market truckload shipments over 250 miles, based on DAT RateView data contributions.

On the dry van side, Charlotte and Memphis entered the top 10 in 2020, replacing Indianapolis and Elizabeth, NJ, two markets that were in the top 10 in 2019. The highest-trafficked van lane was Ontario, CA, to Stockton, CA.

For reefers, the top lane was Atlanta to Lakeland, FL, while the busiest flatbed lane was Houston to Lubbock, TX.