Will the recent tariffs lead to a full-blown trade war? Not so fast, says Donald Broughton, managing partner at Broughton Capital, in an interview on CNBC.

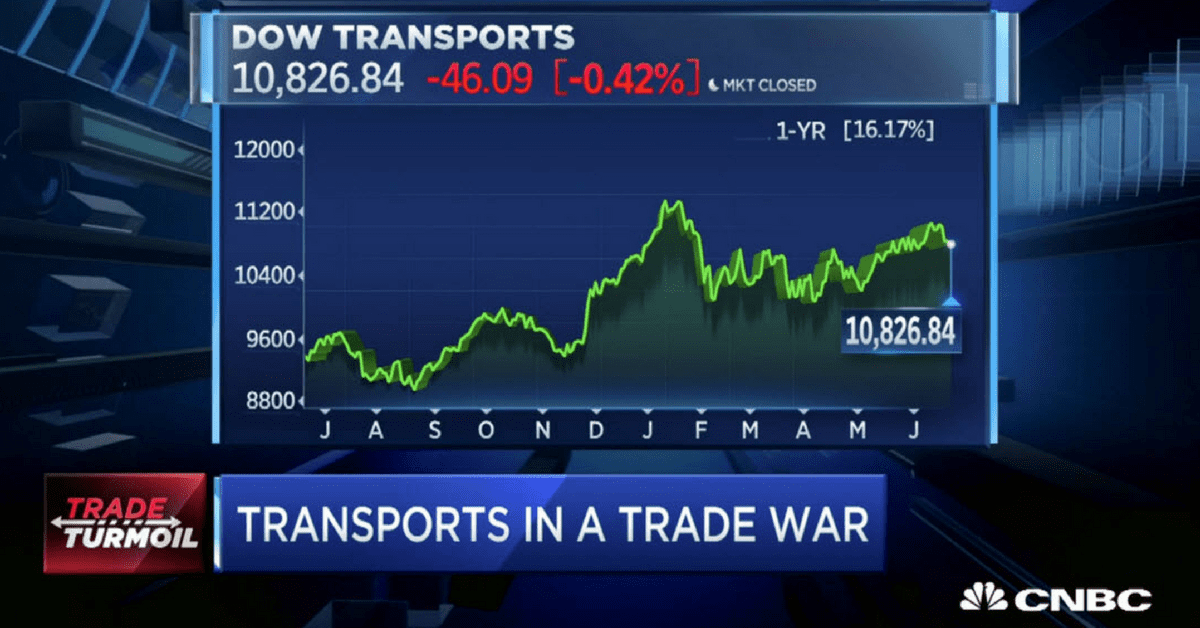

Broughton, a longtime financial analyst who focuses on the transportation sector, considers those transport stocks to be the most accurate bellwether of economic change. While semiconductors and auto manufacturing will be affected by tariffs, the earliest clues to a changing trade environment can be found in freight flows.

Click the picture below to view the 2.5-minute video segment on CNBC.

That’s why transports are a leading indicator, signaling market volatility even before semiconductor stocks start to move. For example, air freight will tell you what’s going to happen with semiconductors, Broughton said. As much as 70% of air freight from the Asia Pacific region is comprised of high-value, low-density products, such as cell phones, that include one or more semiconductors each.

Sign up for DAT Trendlines, our free weekly report on spot market rates and truckload capacity.

Broughton sees no indication that the transports themselves will go into a decline, after a multi-year bull market. On the contrary, asset utilization is improving at transportation companies, which is a boon to the capital-intensive industry.

Spot market truckload data from DAT also figures into Broughton’s thinking. He developed a set of DAT Freight Barometers that illustrate the value of spot market metrics as leading indicators to economic trends.