If you watch the evening news, you might think there’s a recession coming any minute now. An online search for the phrase “recession 2019” returned 22.6 million results, but I’m not jumping on that gloom-and-doom bandwagon.

In fact, data from the trucking industry makes me feel optimistic about the next 12 to 18 months, however. Freight volume continues to grow, above and beyond the record results of 2018. Lower taxes, increased productivity, and near-zero unemployment lead to increased spending by businesses and individuals alike. Now industrial investments and construction are rebounding after a long, harsh winter, and consumer spending continues to expand.

Freight volume supports optimistic outlook

One big reason for optimism: truckload freight volume is increasing, not declining. The American Trucking Associations reported a 6.8% increase in truck freight tonnage in 2018, and additional month-over-month increases in the first quarter of 2019, before seasonal adjustment. Trucking is a leading economic indicator, representing 70% of all domestic freight transportation, according to the ATA.

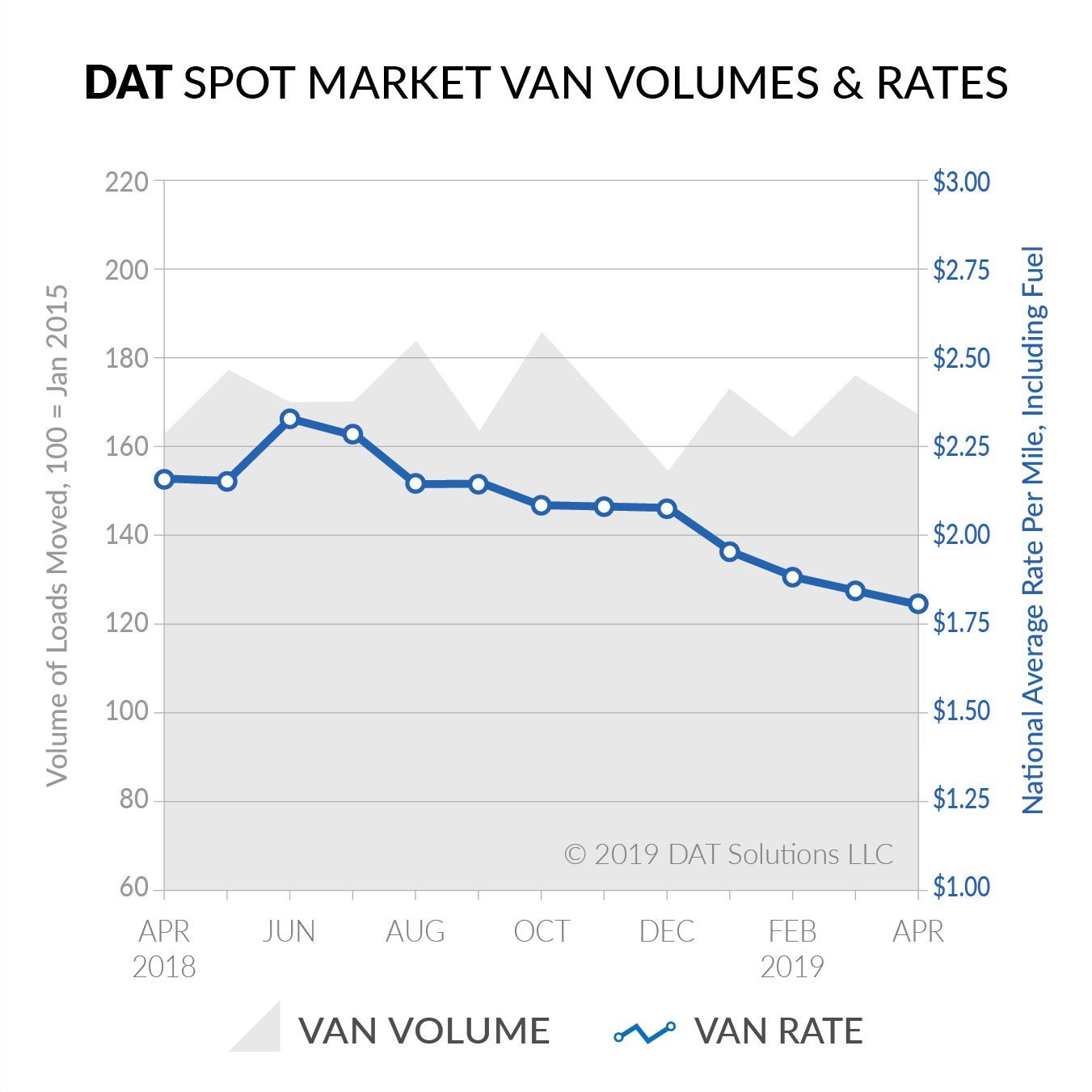

Spot market freight trends lead trucking, and DAT is the definitive source of spot market data. That means you can learn a lot about the future health of the U.S. economy by following DAT. Spot freight volume is rising slowly but steadily, even though rates have dropped sharply from the record highs of mid-2018. The sliding rates are a result of a big increase in available capacity. To put it plainly: there are a lot more empty trucks. When rates go down, the revenue per trip declines too.

Keep up with the trends that affect your business, with custom reports from DAT Data Analytics.

2.4% more spot market loads moved on dry vans, the most common equipment type in Q1 2019 compared to the first quarter last year. The rate per mile has declined since June 2018, however, because more trucks are available to compete for that freight.

Lean times for oil and soybeans

Not all the news is good, however. Some sectors of the economy are slowing down, notably oil and gas, as well as the agricultural commodities and other products that we would typically export to China. I foresee a revival in the oil patch later this year, as oil prices rise due to pressure from international markets. I don’t expect the new tariffs to last very long. Meanwhile, some consumer and industrial goods will cost more. Those products are itemized in a 194-page list published by the U.S. government. Some American companies will likely enjoy renewed demand for substitute items, which is generally good for the domestic economy, even if it’s a little harder on our individual budgets.

U.S. exports to China will also be reduced due to retaliatory tariffs and other actions by the Chinese government. That will have an impact on many American farmers, including those who export soybeans. Pig farmers may continue to enjoy brisk sales to China, on the other hand, because of a deadly swine fever that is decimating herds across much of Asia.

Growth may slow, but remain steady

These are real concerns, but they represent only a portion of the economy. The ripple effects could lift U.S. inflation rates from the current record low, and add even more churn to the volatile stock market. Will that have a profound, lasting impact on the economy? Maybe not.

Trucking is entering a slow-growth phase after the roller coaster ride of the last two years. From mid-2017 through mid-2018, truckload rates soared upward by double digits, and everyone in the industry celebrated. Shippers, on the other hand, were traumatized by the rapid increase in their transportation costs. They responded by locking down truckload capacity with contract terms that favored carriers. This year, contract rates are settling back down, and spot rates dropped precipitously, but they still haven’t reverted to 2016 levels.

Some transportation and logistics companies are thriving in this new environment, while others are losing traction. Meanwhile, the volume of truckload freight continues to grow. That’s good for the future of our industry, and for the economy as a whole.