The U.S. is the world’s largest turkey producer and exporter of turkey products by far. It accounts for 52% of global production, followed by Germany and Brazil with 10% each.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Domestically, turkey production is scattered with 174 plants located in 20 states. The following five states account for 58% of production:

- Minnesota

- North Carolina

- Arkansas

- Indiana

- Missouri

According to USDA data, these top five states produce around 140 million live turkeys at an average live weight of 30.57 pounds. Most production plants are located within 100 miles of farms. Because of the regional location of farms and processing plants close to feed sources, the outbound truckload freight task typically involves a much longer length of haul given the distance to distribution centers located close to major consumer markets.

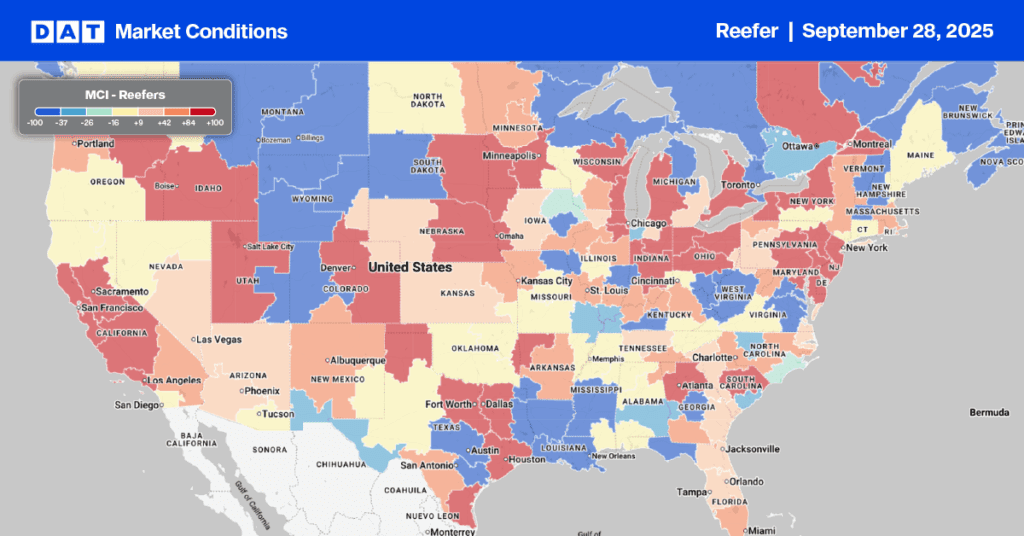

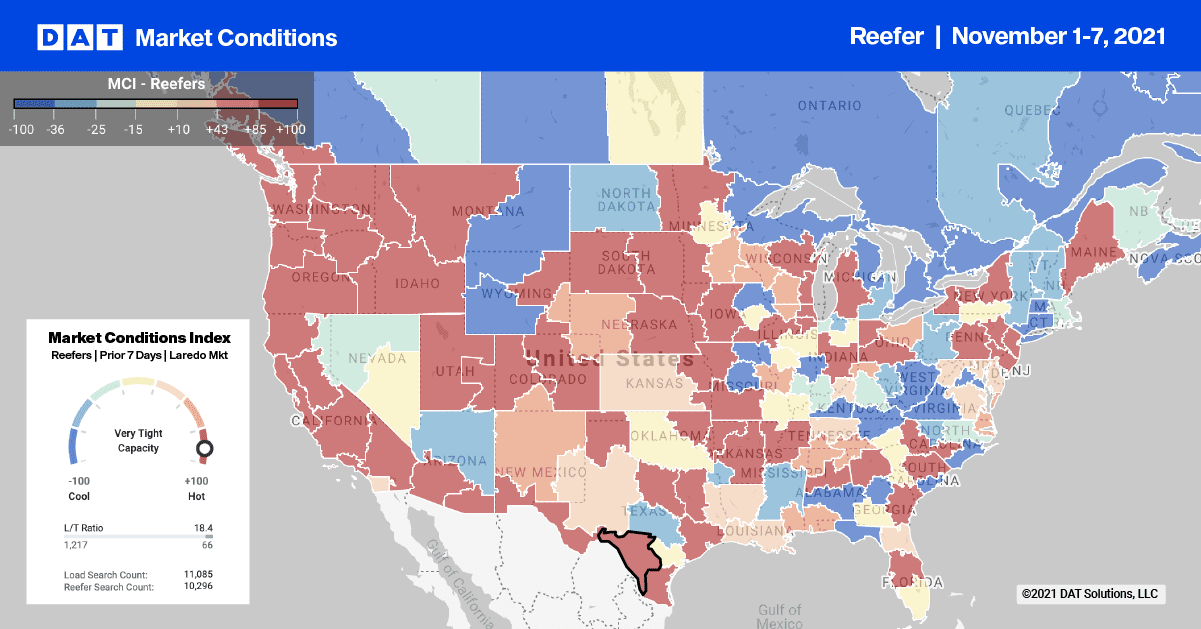

Minnesota has consistently ranked first in U.S. turkey production, raising 40-42 million birds each year. It’s one of the major turkey-producing states we’re watching closely this Thanksgiving. Minnesota includes both the Minneapolis and St. Cloud freight market with St. Cloud, MN roughly at the center of turkey farming activity — or what’s known locally as the “turkey belt.”

Reefer loads out of this region are up 5% compared to last week and 21% compared to last month. Spot rates are holding steady this week at an average outbound rate of $3.44/mile.

On some long-haul lanes including St. Cloud, MN to Los Angeles, spot rates are up $0.07/mile to an average of $2.46/mile. Loads east to New York City are averaging $3.99/mile, which is $0.56/mile higher than this time last year.

Capacity is already tight on the 1,600-mile haul to Orlando. Spot rates are averaging $3.70/mile, which is almost $1.00/mile higher than last year.

In addition to dry van capacity inbound to Denver being tight last week, reefer capacity was also in demand following a 11% week-over-week increase in load post volumes. Average reefer outbound spot rates to all destinations held steady at $1.95/mile. Inbound loads from Los Angeles jumped to $4.71/mile, an increase of $0.72/mile above the October average rate and $0.91/mile higher year-over-year.

In the Southwest Region, capacity tightened last week also. Load post volumes were up 15% compared to the previous week with average spot rates up $0.14/mile to $2.78/mile. Loads on the 2,400-mile haul from Tucson to Brooklyn averaged $3.22/mile last week, $0.30/mile above the average for October.

In the Mid-Atlantic Region (includes NC, the #2 turkey producing state) reefer rates were up $0.20/mile last week to an average of $2.58/mile. On the high-volume lanes from Atlanta to Orlando, spot rates were up $0.07/mile to an average of $4.26/mile and up $0.15/mile on the return journey to an average of $1.79/mile.

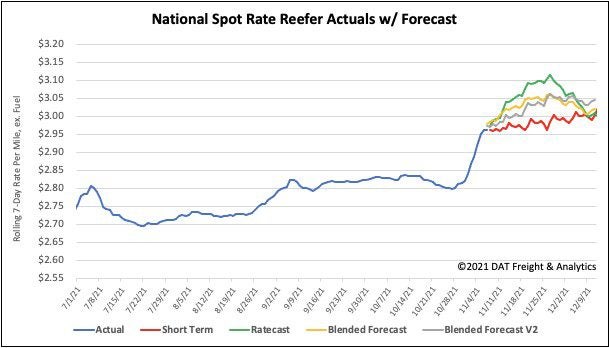

Spot rates

The reefer spot rate ended last week up $0.12/mile to a national average of $2.96/mile. This is still 19% or $0.57/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 29 lanes (compared to 21 the week prior)

- Remained neutral on 24 lanes (compared to 35)

- Decreased on 19 lanes (compared to 16)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models