At last month’s Mid-America Truck Show (MATS) ProTalk sessions, numerous new carriers in the trucking industry asked what they should focus on. My answer was easy: understanding the demand for what you haul is critical to pricing, lanes, trailer type, freight market strategy, and profitability. In addition, new carriers must also invest in trusted and reliable business partners to guide them along the way. And yes, it’s an investment, not just a line item on the profit and loss sheet.

In very few instances worldwide, truckers create demand for what they haul. Instead, demand is derived from a transaction they have little control over, i.e., consumers buying goods and manufacturers making them. That makes most for-hire trucking companies price takers who traditionally take a cost-plus approach to pricing. That makes knowing your costs table stakes in the fragmented industry where 95.7% operate ten or fewer trucks and 99.7% operate fewer than 100 trucks. It’s also highly competitive, which makes becoming a student of the trucking industry the starting point for success.

You’ll have to now if you didn’t like reading as a student.

Too many get caught up in industry politics and gossip on social media as their primary source of information. This can be misleading and send a new carrier down the wrong road, ending in despair and possibly economic failure.

The first thing a new carrier needs to do is change the channel. Tap into sources of information that are objective and laser-focused on the type of freight you haul. Because if you don’t wholly understand consumer and manufacturing trends in the industry you’re specializing in, what chance do you have?

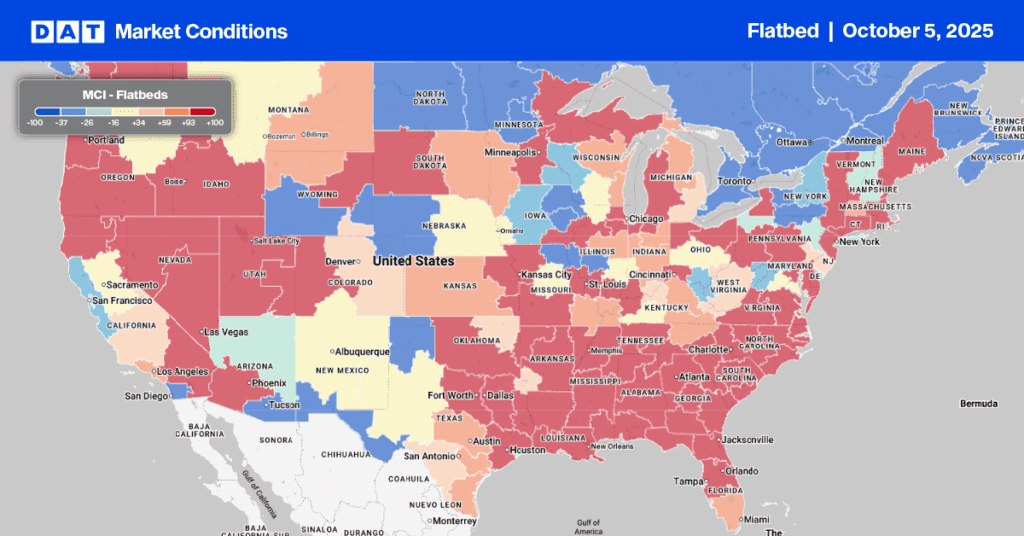

I own a flatbed; what should I focus on?

Take flatbed carriers, for example. In the last 12 months, we’ve seen the housing industry collapse under the weight of supply chain disruptions, labor shortages, and, more recently, record-high interest rates. Knowing the directional trends of the number of new homes being built is critical to understanding flatbed demand for products like lumber, roofing, and steel. You can go one step better and study the number of new building permits being applied for by builders since permit applications precede a housing start of one to two months.

Where do you find this information? The U.S. Census Bureau publishes this data along with a summary report around the middle of each month, and it’s free!

Suppose you’re a regional flatbed carrier in Texas, for example. In that case, the weekly BakerHughes Rig Count is a great way to see which way demand is headed for drill pipe and casing products used in energy exploration.

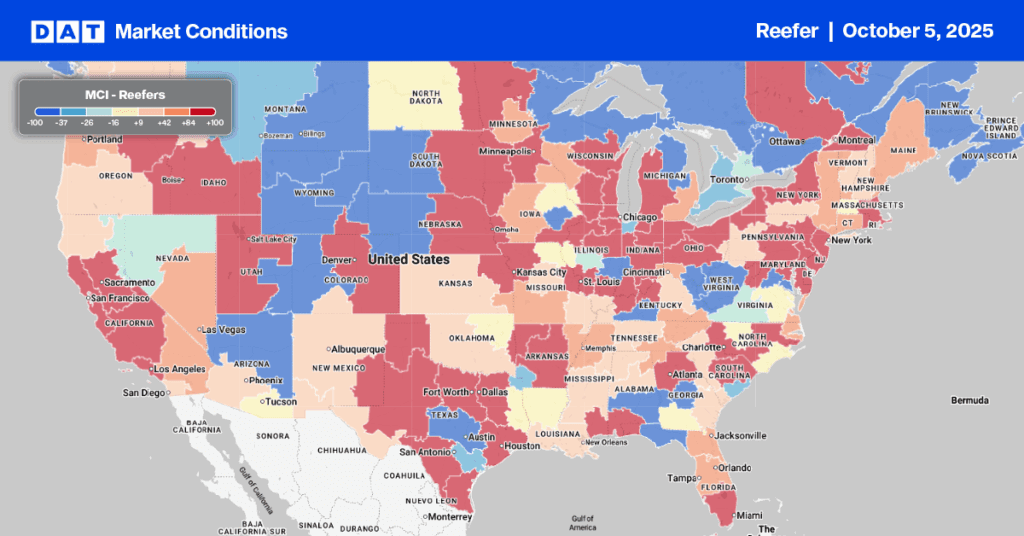

What if you’re a reefer carrier and want to know which produce-growing regions are hot?

That’s an easy one, as the United States Department of Agriculture (USDA) published lots of free reports and data and easy-to-consume data dashboards. The first report to follow is the USDA Truckrate Report, which lists the growing regions, the type of fruits and vegetables, and most importantly, whether or not there’s a shortage of over-supply of trucks.

The USDA also has lots of data on the volume of produce being shipped in growing districts around North America. Another great way to see when produce is starting in a region is to follow the festivals in the news. Each region usually holds a festival to celebrate the start of the season, some at the peak of the season, like the Florida Strawberry Festival in Plant City, FL, usually in late February each year.

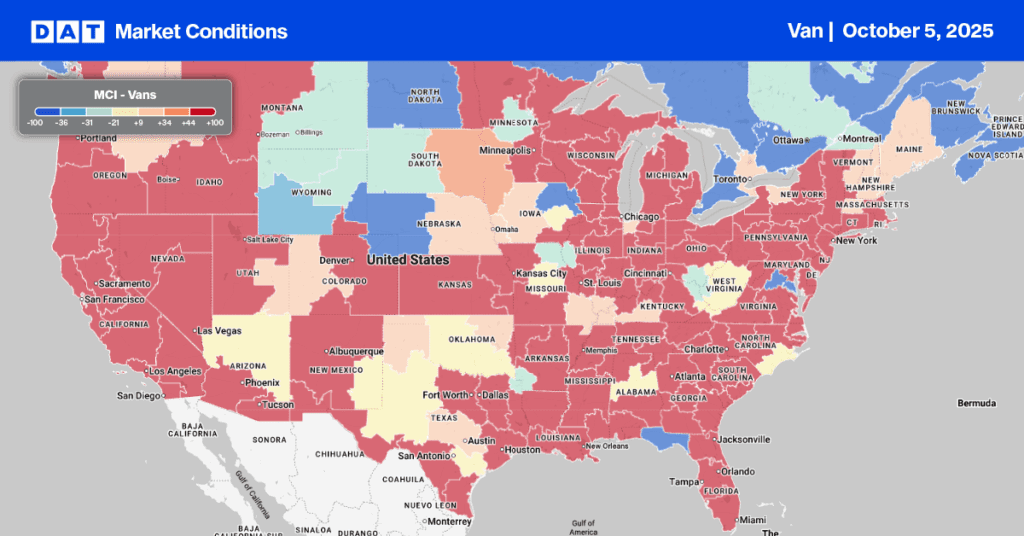

I’m a dry van carrier – what should I be watching?

Dry vans can haul such a wide variety of goods it makes more sense to look at broader economic indicators as opposed to specific industries like reefer and flatbed. Manufacturing data would be at the top of the list, with the Logistics Managers Index (LMI) and the Institute of Supply Management (ISM) Purchasing Manager Index (PMI) as excellent sources published in the first week of each month.

The U.S. Census Bureau reports on Durable Goods Manufacturers’ Shipments, Inventories, and Orders towards the end of each month, publishing a summary report and data for further analysis.

If you want to skip all that and follow an industry expert, look no further than supply chain professor Jason Miller at the Michigan State University – Eli Broad College of Business. He’s regarded as the most insightful expert on all matters related to supply and demand for the trucking industry. Connect with him on LinkedIn and make sure he’s your first stop of the day. Jason also produces the Truckload Ton-Mile Index (TTMI), which tracks demand for 41 freight-producing commodities and is published typically in the second week of each month.

Other dry van data include the American Trucking Association (ATA) Truck Tonnage Index, Cass Freight Index, and the Freight Transportation Services Index (TSI) published monthly by the Bureau of Transportations Statistics.

But wait, there’s more.

If you don’t want to do all that and love listening to podcasts, join the DAT Freight & Analytics weekly DAT iQ show live on Tuesdays at 10 am Eastern. Subscribe to our YouTube channel and set up alerts to never miss an episode. Do the same for the bi-weekly Freightvine podcast, where Professor Chris Caplice and Dr. Inam Iyoob get to the bottom of what’s happening in the transportation markets from the shipper’s perspective.