Freight rates typically decrease throughout January each year, but the pace for this month does appear to be accelerating, as spot market volumes drop, contract rates rise, and overall freight volumes remain down year over year.

There are still areas where demand is increasing, despite the overall declines. Consumer packaged goods (CPG) is an industry term for merchandise that customers use up and replace on a frequent basis, and according to consumers sales firm IRI, total CPG demand increased by 8% y/y for the week ending Jan. 10.

The Home Care category is now up 28% compared to year ago. Sales of Laundry, Household Cleaning and Air Fresheners categories are up 11%, 9% and 10% w/w respectively.

Find van loads and trucks on the largest on-demand freight marketplace, operated by DAT One.

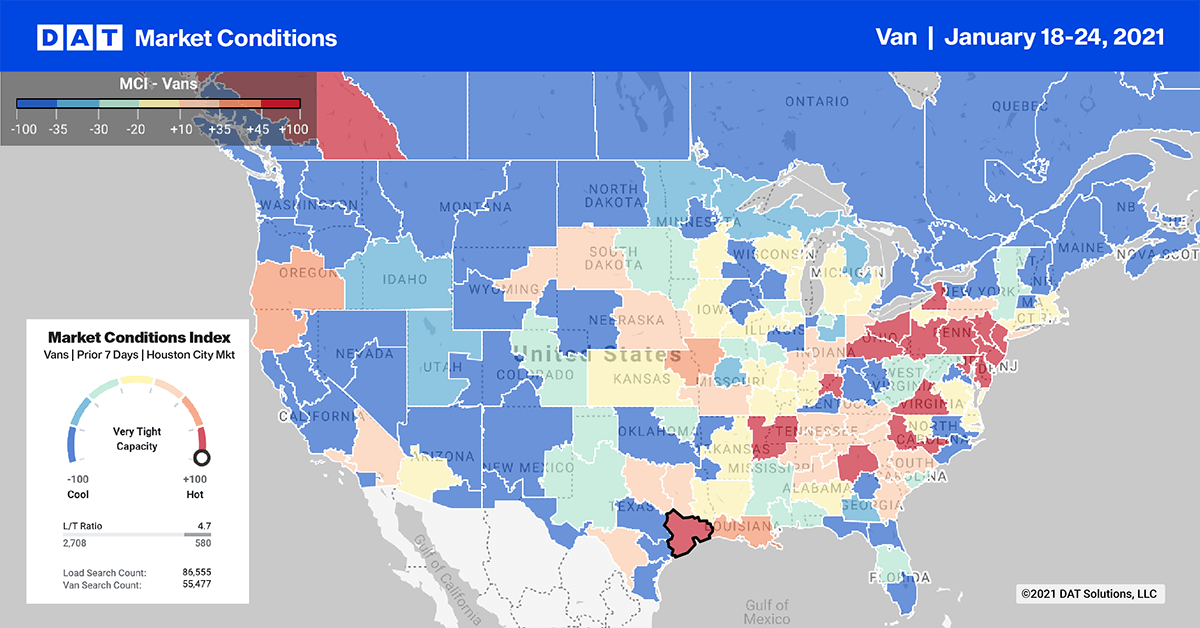

Dry van load post volumes dropped by 10% week over week in our top 10 markets again last week, putting more downward pressure on spot rates that fell on average by $0.11/mile for the second week in a row.

Elizabeth, NJ, saw volumes drop 7% w/w and rates dropped for the fourth week in succession, decreasing by $0.05/mile to $1.87/mile (minus fuel). The top three long-haul lanes for dry van loads outbound from Elizabeth were Chicago, Lakeland, FL, and Atlanta last week. The most notable drop in rates were on the Elizabeth-Lakeland lane, where the 3-day average decreased to $2.43/mile, with some loads as low as $1.79/mile.

In Memphis, volumes dropped 20% w/w, with looser capacity driving down rates $0.15/mile to $2.35/mile. Further south in Houston, rates dropped $0.10/mile to $1.93/mile.

On the West Coast, Ontario, CA, and Los Angeles volumes increased slightly, but capacity was still loose, pushing down rates by an average of $0.13/mile in Ontario and $0.17/mile in Los Angeles. Outbound spot rates in both markets have plummeted by close to $0.50/mile in the last four weeks.

Spot rates

Dry van rates continued to slide last week, dropping by $0.04/mile to end the week at $2.08/mile (excluding FSC). Rates are still $0.53/mile higher than the same week in 2020, when they were $1.54/mile excl. FSC, but with contract rates on the rise and now 16% higher y/y, more downward pressure on spot rates can be expected in coming weeks.