Van rates continued to rise in the week after the annual Roadcheck inspection blitz, and we expect the end of June to bring record high rates for the three big equipment categories. As of today, the national average van rate of $2.30 per mile for the rolling month to-date exceeds the previous high of $2.24 per mile in early January. That puts June on track to exceed January’s record.

Outbound rates rose by more than 3% on major lanes originating in Los Angeles and Stockton, while rates rose 5.6% on high-volume lanes leaving Memphis, to an average of $3.06 per mile. Rates were up 2.4% on top lanes out of Atlanta, too. That’s a more modest gain, but still significant for a single week.

Several key markets had double-digit increases in outbound volumes, as well, signaling strength in carrier pricing. Notably, volumes increased sharply in four of the largest and most important freight markets in the country: Los Angeles and Atlanta, with substantial rates increases noted above, but also Chicago and Dallas, where last week’s rate increases were under 2 percent, but could rise more before the end of the month.

Interestingly, the national average load-to-truck ratio fell 8.4% for vans last week, as more trucks became available after Roadcheck. At 10.3 loads per truck, the ratio is still crazy high.

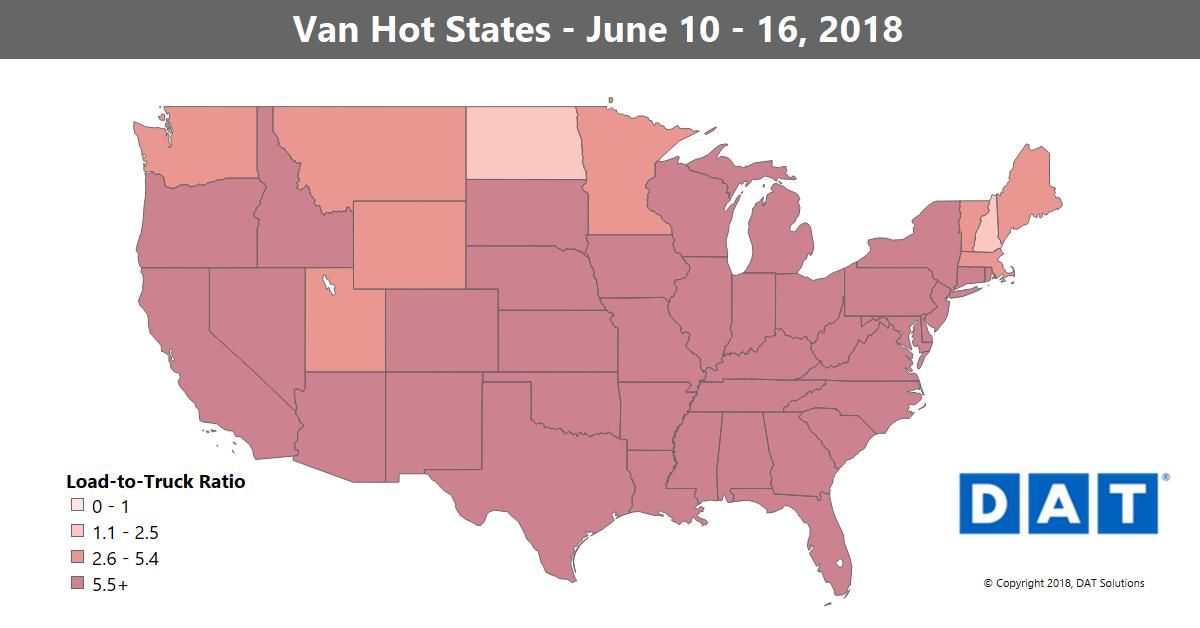

In mid-June, more trucks are becoming available, but demand for van equipment remains strong. Load-to-truck ratios and rates have peaked in June in previous years, and 2018 appears to be following that seasonal trend. The map depicts outbound load-to-truck ratios for dry vans in the 48 contiguous U.S. states, and darker colors correspond to higher ratios. The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. The ratio is a sensitive, real-time indicator of the balance between demand and capacity, and changes in the ratio typically signal impending changes in freight rates.

What’s Hot: Los Angeles and Stockton, CA

The average rate out of Los Angeles will probably top the $3 mark this month. Last week it was $2.98/mile. Most of the top gaining lanes were within the Western region.

- Stockton, CA, to Seattle rates jumped up 31¢ to $3.80/mile

- Stockton to Salt Lake City climbed 30¢ to an average of $2.87/mile

- Los Angeles to Seattle also jumped up 23¢ to $3.75/mile

- In other regions, a lot of the increases were on lanes heading to the West Coast. One exception was also westbound, but didn’t go the whole distance: Memphis to Dallas rates rose 23¢ to $3.07/mile

What’s Not: Buffalo, NY

As we seem to be repeating every week lately, only a few lanes fell by more than 10¢/mile:

- The regional lane from Buffalo to Allentown, PA, fell 16¢ to $3.34/mile

- Buffalo to Chicago also fell 14¢ to $1.94/mile

- Houston to Dallas has been hot lane lately, but it fell back 14¢ last week to $2.83/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.