Here comes the winter slump. Van rates slipped below December levels last week, after an unexpected surge in the first half of January. The national average rate dropped another penny to $1.93 per mile for vans. That’s 1¢ below the December average but higher than any other month since December 2018. Volumes declined week over week, but there were still plenty of loads moving, even when compared to the pre-holiday rush that peaked a month ago.

This year’s slump is starting late and is expected to end early, which is good news for truckers. We’re likely to see a rebound as soon as six weeks from now, and the 2020 rate forecast puts year-over-year comparisons solidly in the plus column by the end of March. Also, there are some markets and lanes where shippers and freight brokers are still clamoring for trucks and rates are stable or rising. So hang in there.

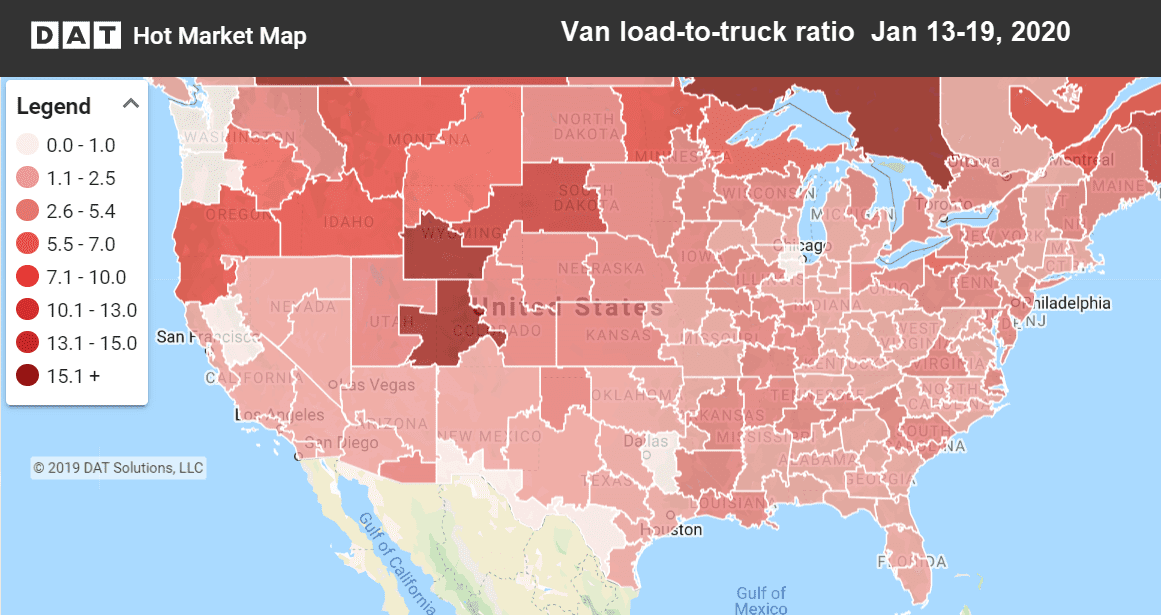

Hot Market Maps display the load-to-truck ratio for each of 135 freight markets. These interactive maps can be found in DAT Power and DAT RateView.

The forecast this week is more snow across the top half of the country, from the West to the Plains and Midwest, and onward to the East Coast, while heavy rain is expected in the South from Houston to the Florida panhandle, and as far north as Tulsa and Memphis. By the end of the week, the whole cold, soggy mess is expected to stretch from Minneapolis to Miami. Yuck. Double-check your wiper blades right now.

Rates are rising on lower-priced lanes

Unfortunately, most of the lanes with big rate increases didn’t pay all that well to begin with, and the rate for the return trip often falls, offsetting the gains. Here are the lanes where the roundtrip average is improving or is already priced well for carriers, in light of the seasonal trend.

- Seattle to Spokane jumped 12¢ to $3.29 and Spokane to Seattle lost 4¢ to $2.84, although there aren’t a lot of loads in that direction. The roundtrip takes a little over two days, at an average of $3.06.

- Denver to Phoenix was up 4¢ to $1.34 per mile, and Phoenix to Denver paid $2.27, down 10¢. That roundtrip at $1.81 is not great. Try Denver to Albuquerque and back instead, at $2.06 per loaded mile.

- Dallas to Memphis gained 5¢ to $1.33 per mile, while Memphis to Dallas dropped 4¢ to $2.38. The roundtrip comes to $1.86 per loaded mile, which is below the national average. Not fabulous.

- Chicago to Los Angeles added 5¢ to reach $1.55 and L.A. to Chicago declined 2¢ to $1.37. Those rates still aren’t great at a roundtrip average of $1.46, but at least there are lots of loads.

Northeast and West Coast rates slip lower

Many lanes with price fluctuations are in the projected storm zone this week, so rates and routes could change. Check road conditions before negotiating, and proceed with caution.

- Allentown, PA, to Cleveland dropped 8¢ to $1.67 and Cleveland to Allentown fell to $3.13. The roundtrip paid an average of $2.40 per loaded mile. If the weather holds up, that could be good enough.

- Buffalo to Chicago lost 15¢ to $1.62, and the return trip from Chicago to Buffalo paid $2.61, for an average of $2.12 per loaded mile on the roundtrip. Watch the weather report on that route.

- Los Angeles to Stockton, CA, plummeted 20¢ to $2.68, and Stockton to L.A. fell to $1.59 per loaded mile, a 14¢ drop. Roundtrip average was $2.14 last week. Not terrible, and there’s a lot of freight.

Whether you’re on the road in a big rig or just shoveling your own driveway, stay safe, warm, and dry.

RELATED: Flatbed rates see off-season surge