Spot market freight showed signs of renewed life last week, even though rates slipped lower compared to the week before last.

The good news: average van rates were higher in July than in June, which is not the usual trend. Flatbed rates peaked at the beginning of July and then dropped down, as a national average, but rates are up for outbound loads from Southeastern markets.

More good news: load availability ended July on a high note, and load-to-truck ratios increased for all equipment types. That usually means that there are fewer trucks, and less competition, chasing the same loads. If this trend continues, rates could start moving up again.

The national average van rate dipped 1¢ last week to $1.64 per mile. What’s unusual is that the average for July was higher than the June rate. Load availability was also up, and load-to-truck ratios improved. Those positive signals are usually followed by rate increases. Memphis had more loads last week, as it replaced Houston as the number 3 market for load availability, following Atlanta and Dallas. Memphis outbound rates were down for the week, but rates are rising in the Midwest, starting with Columbus. This could be due to retail re-stocking for back-to-school season, which would be a good sign.

The national average flatbed rate has been rising steadily since the first week in July, but it hasn’t returned to June levels yet. On a lane-by-lane basis, flatbed trends swung wildly. Rates were hurt by changes in the mix of cargo. Also, when demand slacks off for van and reefer freight, there are more trucks available. That extra competition drags flatbed rates down, too. Rates peaked around the July 4th holiday, and then we had these big rate swings for the rest of the month. One common theme: A lot of the lanes with rising rates go into or out of big markets in the Southeast. Hot Markets include: Jacksonville, Savannah, Raleigh, and Roanoke.

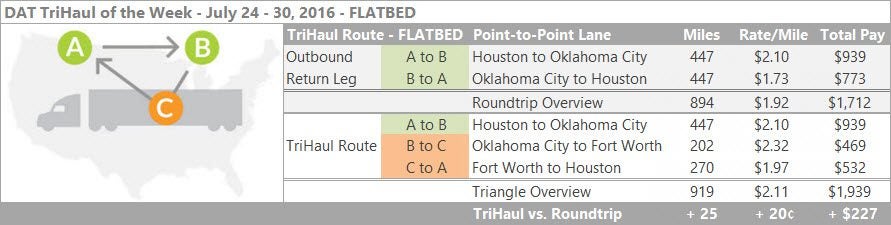

DAT Flatbed TriHaul of the Week: Houston – Oklahoma City – Ft Worth – Houston

You can always find a flatbed load out of Houston, but it’s hard to find anything like the same opportunity going back to Houston from any location. If you have a good roundtrip, say, between Houston and Ft Worth or Houston and Oklahoma City, you don’t want to mess with it, especially if you can do the 900-mile trip in two days, including load and unload times. If you’re running into a third day or you just want to try something new, pick a second destination with a reliable source of loads for your trailer type.

So, you’re taking a load from Houston to Oklahoma City, and then you haul a second load from Oklahoma City to Fort Worth. That breaks up the return trip. It also improves your rate from $1.73/mile to $2.12/mile on the way back from Ft Worth to Houston. You’re adding only 25 loaded miles to the trip, so it’s a $227 boost to your total revenue, from $1,712 to $1,939 for 900-ish miles.

Lane-by-lane rate information and TriHaul route recommendations are available in DAT load boards. Rates are based on DAT RateView, with $28 billion in lane rates, updated daily, for 65,000 point-to-point lanes across North America.