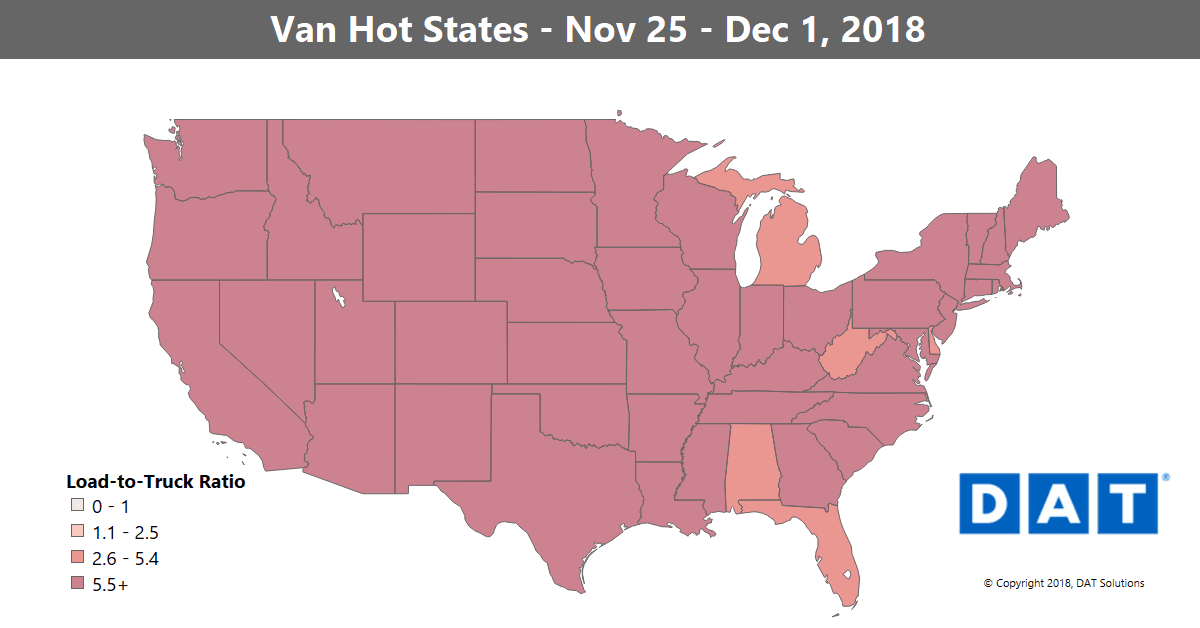

Everyone came back from Thanksgiving break with plenty of work to do last week. Truck posts on the DAT load board were up 21%, which is right in line with what’s typical when comparing a full work week to a holiday week. But load posts shot up 54%, so demand for trucks is hot right now.

That pushed the national average van rate higher, with demand fueled by e-commerce and retail. The picture was a bit more mixed regionally, with some softer markets on the West Coast as demand shifted east. But capacity has gotten tighter across the country, and on the top 100 van lanes, 63 had higher rates.

Retail shipments pushed rates higher out of Columbus, and Seattle pricing improved, offsetting some of the falling rates in California.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

Rising lanes

- Columbus to Buffalo, up 31¢ to $3.99/mile

- Philadelphia to Columbus, up 20¢ to $1.84/mile

- Out West, Seattle to Spokane rose 31¢ to $3.78/mile

- Salt Lake City to Stockton rose 19¢ to $1.66/mile, which is a relatively high price for a lane that otherwise pays low rates most of the time

Falling Lanes

Outbound rates from Los Angeles are still 11% higher than they were a month ago, but they took a big dip last week.

- L.A. to Dallas lost 24¢ at $2.41/mile

- Stockton to Denver dropped 27¢ from its peak, down to $2.74

- Out East, higher demand for outbound van freight from Allentown, PA, push prices down on the inbound lane from Buffalo, which lost 20¢ at an average of $3.49/mile

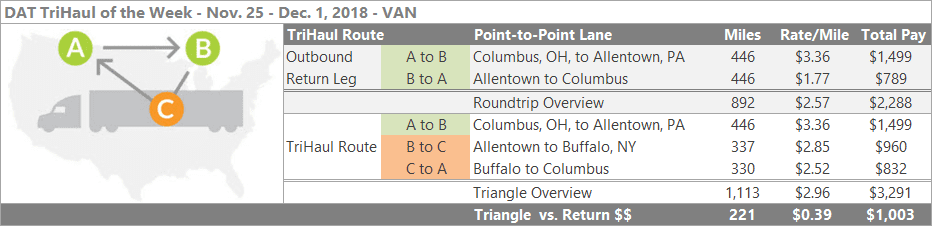

TriHaul of the week – Retail edition

With e-commerce boosting demand for retail freight, carriers can take advantage of the higher rates out of markets that serve as warehousing and distribution hubs. For example, van rates from Columbus to Allentown were up to $3.36/mile. Rates on the trip back averaged $1.77, which still makes for a good roundtrip, but if you have the available hours, you can head from Allentown to Buffalo instead.

That lane paid $2.85/mile on average, and the trip back from Buffalo to Columbus averaged $2.52. The extra legs on the trip add about 220 miles, not counting deadhead, but just negotiating the average rate on each leg could boost your revenue by $1,000 and add 39¢ to your average rate per loaded mile.

Find higher-paying routes with the TriHaul tool, available in DAT TruckersEdge Pro.