Independence Day fell on a Thursday this year, so there were many people who took Friday off as well. That meant any shipments needing to be delivered last week had a tighter window, and as a result, those shipments moved at a premium. The average van rate during the shortened holiday week was $1.93/mi., which was 4¢ higher than the June average and 14¢ higher than May.

Freight volumes and rates typically slip after the 4th of July holiday rush, but e-commerce sales next week could keep the upward pressure on prices.

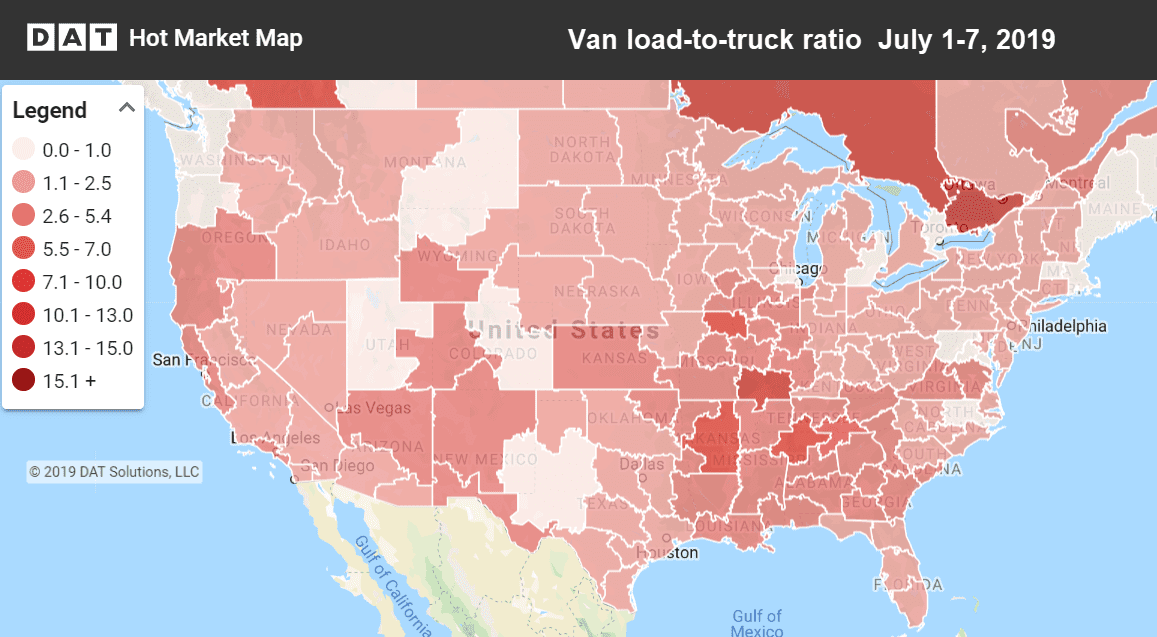

Hot Market Maps in DAT Power and DAT RateView show where trucks are hardest to find. The darker the color, the less competition there is for truckload freight.

As seen in the graph above, load posts and truck posts peaked on Monday, bottomed out on the 4th of July holiday, and then saw an uptick on Friday.

Rising Rates

The Midwest is finally seeing higher pricing as weather continues to warm up. Seattle had been sinking much of the second quarter but rebounded a bit last week.

- Memphis to Indianapolis jumped 22¢ to $2.56/mi.

- Dallas to Houston increased 14¢ to $2.51/mi., reacting to soft conditions in Houston

- Stockton, CA, to Salt Lake City rose 15¢ to $2.60/mi.

Falling Rates

Most markets performed well last week, but the Houston market did see a decline. Over the past month, rates have fallen about 4% coming out of Houston, likely because of a slowing oil market in Texas.

- Memphis to Chicago fell 12¢ to $2.29/mi.

- Los Angeles to Seattle dropped 11¢ to $2.78/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.