Van load availability dropped another 9% on the spot market last week, while truck posts on DAT Load Boards held steady (up 0.6%). As a result, the national load-to-truck ratio fell from 1.6 to 1.4 loads per truck.

Harvests in Idaho are down from their fall peak, but demand in the southern part of the state remains high. Expect volume to ramp up again as Thanksgiving approaches. The Hot State Map for the week of Oct. 11-17 also shows favorable load-to-truck ratios in Oregon. This is due partly to strong seasonal demand in the Medford market area, known for its apple orchards.

Daily maps, along with detailed information on demand, capacity and rates for individual markets and lanes, can be found in DAT Power Load Boards and in DAT RateView™.

Spot market rates slipped 1¢ for vans last week, to a national average of $1.72 per mile. Outbound rates are up 3% for the month in Buffalo, which is fueled by freight entering the U.S. from Canada. Rates trended downward in the Southeast, with prices falling in Charlotte and Atlanta. Outbound rates remained strong in Los Angeles and Chicago. This map of van rates in key regional markets can also be found on DAT Trendlines.

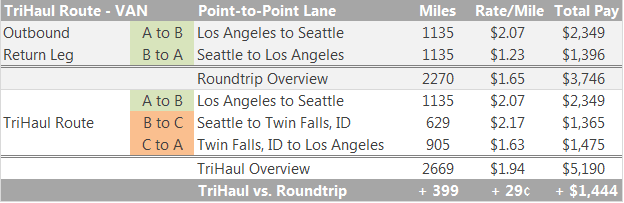

Seattle was a hot market for vans in the past month, but it cooled off last week, and outbound rates dropped. If you’re stuck in Seattle and you need to get back to L.A., look for a TriHaul.

It’s a tight schedule, but if it works with your hours, look for a load to Twin Falls, ID, and a second load from Twin Falls to L.A. You’ll fill out your week and fill your wallet with an additional $1,400 for the roundtrip.

TriHaul route suggestions are offered in DAT Express and DAT Power load boards. Rates are derived from DAT RateView and are based on actual rate agreements between freight brokers and carriers. Reference rates include fuel surcharges but not accessorial or other fees.