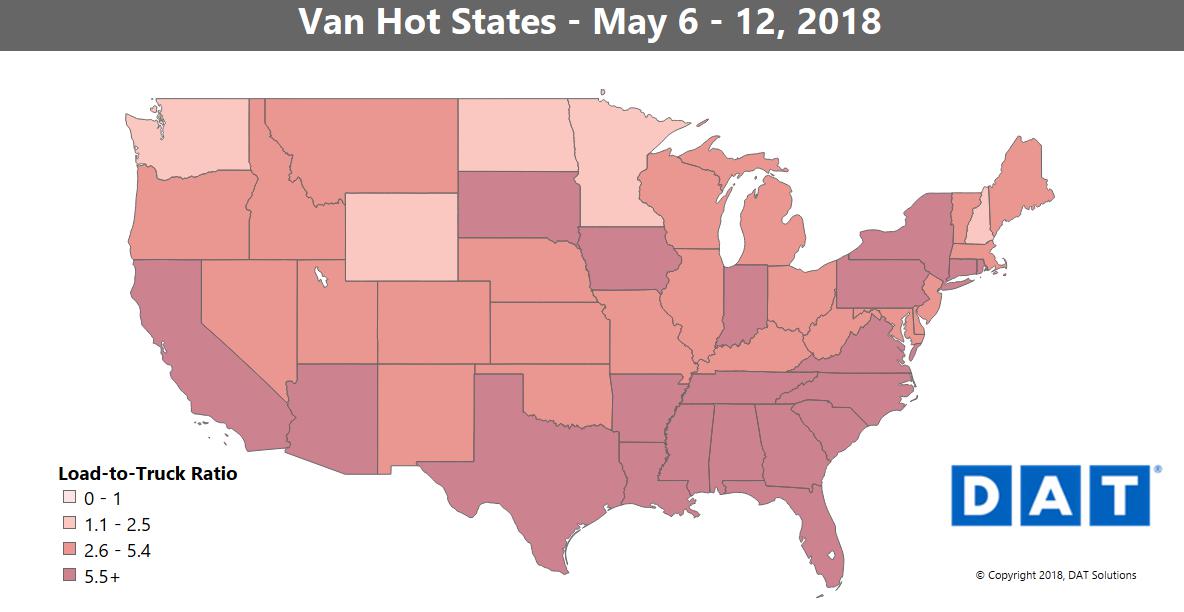

After getting off to a hot start in May, van trends took a slight dip last week in terms of truck loads and rates. That’s still coming from an elevated level, though. Volumes are as strong as they’ve been all year, and capacity is tight across the southern half of the country.

The Midwest and Northeast quieted down, but freight levels are building in California, which has the potential to lift rates nationwide.

RISING

California produce shipments are ramping up, which affects van traffic. For one, it means fewer reefer trucks are competing for dry van loads, but harvests also add to van freight, including tree nuts and canned tomatoes. Rates out of Los Angeles and Stockton, CA, have seen the biggest overall increases in the past month.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

On the top 100 van lanes, the biggest jump was on the intrastate lane from Seattle to Spokane, WA, up 20¢ to $3.13/mile

Lower prices out of Columbus, OH, balanced against higher rates on some inbound lanes. Atlanta to Columbus rates rose 18¢ to $2.32/mile, the highest point for that lane in several weeks.

FALLING

Some lanes came back down last week from previous heights:

- Boston to Allentown, PA, dropped 27¢ to $2.16/mile

- Columbus to Buffalo fell 25¢ at $3.70/mile – prices dropped from Buffalo back to Columbus, too

- Memphis to Columbus lost 19¢ to $2.57/mile, perhaps a sign of slower retail demand once all the Mother’s Day shipments had been delivered

- Chicago to Denver fell to $2.66/mile, a low point in recent weeks

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.