Freight volumes have been building for weeks, but sufficient capacity has kept rates in check so far this fall. The national average van rate of $1.81 per mile is only 1¢ higher than October’s average. On the other hand, the top 100 van lanes showed freight volumes increasing last week and more lanes had rising rates than falling rates. The top 100 lanes are often a predictor of where the national average is heading, so we may see increased strength as we approach Black Friday — which occurs later this year — and the upcoming holiday rush.

Last week several top lanes got a boost of more than 10¢ per mile, while none of the declining lanes fell more than 7¢ per mile.

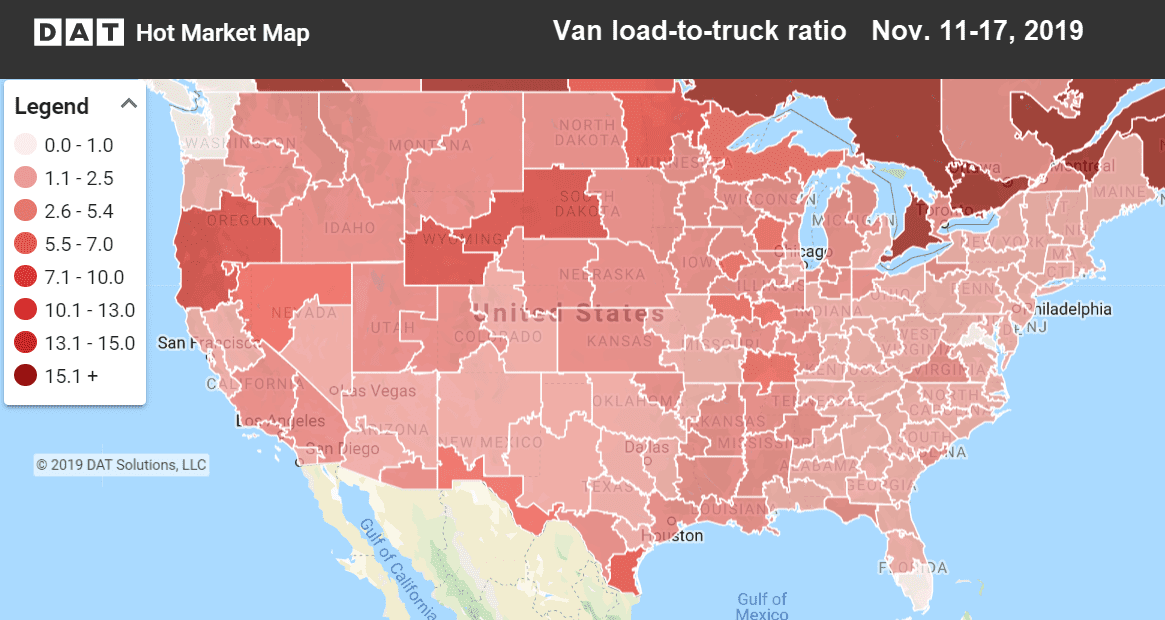

Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Rising markets and lanes

Freight markets where rates increased included Atlanta and Memphis, but the largest average increase came from Denver, normally a low-priced back-haul market. Last week one of the lanes out of Denver hit the $2 per mile mark:

- Denver to Albuquerque jumped up 13¢ to $2.00/mi.

- Memphis to Atlanta gained 10¢ to $2.40/mi.

- Atlanta to Lakeland, FL increased 5¢ to $2.62/mi.

- Chicago to Detroit added 16¢ to $3.09/mi.

Falling markets and lanes

None of the major van markets had any significant declines in rates, but certain lanes experienced falling prices:

- Boston to Allentown, PA slipped 7¢ to $1.81/mi.

- Houston to Los Angeles was also down 7¢ to $1.19/mi.

That rate from Houston to Los Angeles is especially weak considering outbound lanes from Los Angeles are only so-so right now.