Despite the rollercoaster ride in diesel prices in the last two years, so far this year, we’ve seen a relatively stable market in comparison. At around $4.00/gal, ultra-low sulfur diesel (ULSD) prices are $0.24/gal lower than last year and just over 30% lower than the record-high set in June 2022. For owner-operators and small long-haul carriers, diesel represents around 34% of total operating costs or the equivalent of $0.62/mile. It’s a lot, whichever way you look, but we must get used to it in the foreseeable future.

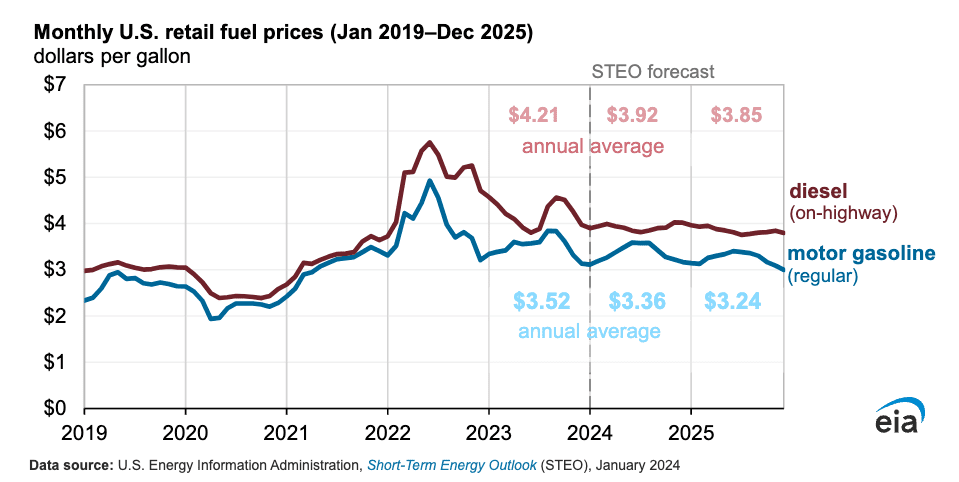

The U.S. Energy Information Administration’s (EIA) Short-Term Energy Outlook (STEO) expects average U.S. retail diesel prices to decrease in 2024 because of increased inventories related to increased refinery capacity.

Goldman Sachs’ latest research forecasts steady Brent crude prices for 2024 and hovering within a $70-$90 per barrel range throughout 2024, “a forecast that spells a period of unusual calm for a commodity known for its unpredictability.” The bank describes a near-perfect equilibrium between supply and demand dynamics in the global oil market.

Goldman Sachs identifies three key drivers underpinning its predictions for the oil market in 2024:

- Modest Geopolitical Risk Premium: The analysts have incorporated a geopolitical risk premium of merely $2 per barrel into their forecast. This modest figure is supported by higher stock levels at sea, which provide a buffer against shipping disruptions.

- OPEC+ and Spare Capacity: The report highlights the elevated spare capacity within OPEC+, suggesting that the cartel is well-positioned to manage potential supply shocks. Furthermore, Saudi Arabia’s decision to maintain its maximum sustainable capacity at 13 million barrels per day is a commitment to market stability. The consolidation within US shale and the measured growth targets of large producers further contribute to this steadiness.

- Tight Supply-Demand Balance: The global oil market is expected to achieve a delicate balance, with demand growth closely matched by increases in supply by non-OPEC (excluding Russia). While growth estimates for various regions are adjusted, the overall picture shows tight alignment between supply and demand.

In an era where the word ‘volatility’ has almost become synonymous with the global oil markets, Goldman Sachs’ latest research note offers a rare glimpse into a future marked by tranquility rather than tumult. The commodities team at Goldman Sachs forecasts steadiness in Brent crude prices for 2024, with anticipated fluctuations being some of the most subdued we’ve seen recently.

Goldman Sachs predicts that Brent crude will hover within a $70-$90 per barrel range throughout 2024, a forecast that spells a period of unusual calm for a commodity known for its unpredictability. This can be attributed to what the bank describes as a near-perfect equilibrium between supply and demand dynamics in the global market.

The EIA expects more diesel production and less strain on U.S. and global inventories to reduce diesel prices in 2024 and 2025 and annual U.S. average diesel consumption to grow modestly by 1.3%, or about 50,000 barrels per day in 2024.

The most recent EAI short-term outlook for diesel prices is that they will average $3.93/gal throughout 2024 and $3.89/gal in 2025.

Figure 1: EIA Short-Term Energy Outlook