Chad Boblett is the owner and driver of Boblett Brothers Trucking of Lexington, KY. Chad also founded the Rate Per Mile Masters group on Facebook, a communications hub for more than 20,000 members, including owner-operators, truck drivers, and other transportation and logistics pros.

I love trucking, but let’s be honest: I am in this business to make money.

The only thing I like better than making money is keeping it. There are two factors that are in my control and that could destroy my business as an owner-operator: my health, and my ability to cover my expenses. (I am very health-conscious — but I’ll save that story for another time.)

This blog post is about the real costs of running a trucking business as an owner-operator, based on my personal experience over seven years. Your costs won’t be the same as mine, but it’s important to keep track of every dollar you spend. I’m not in the business of giving financial advice, so if you want to apply some of these ideas to your own business, please talk to an accountant or another trusted advisor.

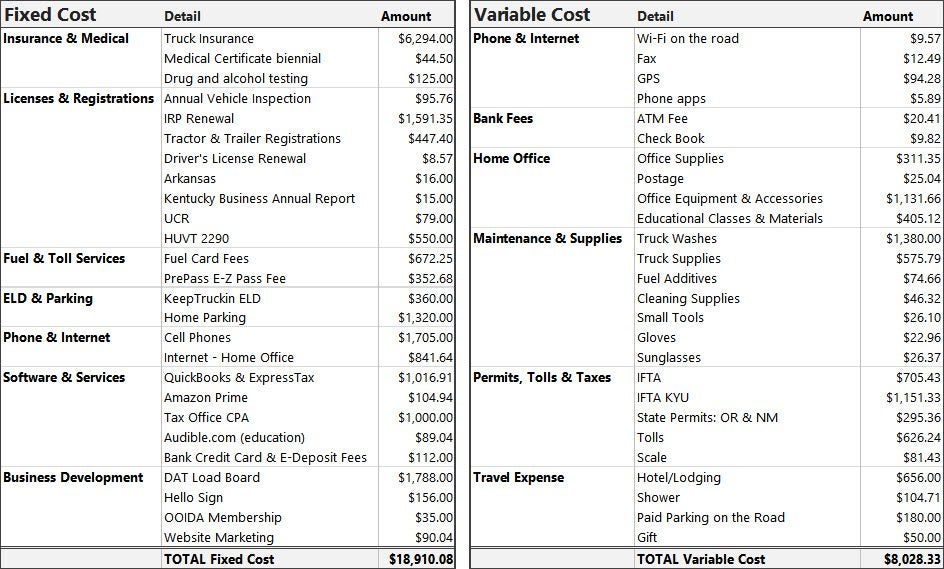

There are two kinds of costs that you need to control in trucking: fixed costs and variable costs.

Fixed Costs Are Predictable. Some Can Be Pre-Paid.

Fixed costs are periodic expenses that remain more or less unchanged from month to month. The upside about fixed cost is that you can predict this number as much as a year in advance. Fixed cost is sometimes called “overhead,” and I don’t like it hanging over my head. So my goal is to pay off as much of that fixed cost as I can, as early as I can, at the beginning of the year. The downside of fixed cost is that you have to pay this expense whether you work or not.

Examples of fixed costs include lease payments and insurance payments on your equipment, annual license and registration fees, software, computers, cell phones, internet service, truck parking near my home, and whatever else you need to run your business. I track every expense, no matter how small. If you maintain an office, or you have employees who are on salary, employee compensation, rent, and utilities would also be counted as fixed costs.

Variable Costs Change With Activity Level, But You Can Economize

A variable cost is a cost that changes in relation to the level of activity in your business. If I don’t drive my truck, almost all my variable costs disappears. Variable costs include fuel, maintenance, washouts, scale fees, and parking on the road. This is the easiest place to cut cost. For example, you can drive 55 MPH, reduce out-of-route miles, use an APU at night, or install aerodynamic gear on your trailer to help save fuel, which is one of your biggest variable costs.

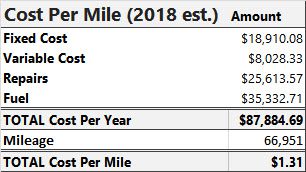

Calculating Your Cost Per Mile

My biggest expenses from the beginning have always been fuel, maintenance and repairs, and tractor and van trailer purchases. The more miles I run, the higher my fuel and mechanic shop cost becomes. The more miles put on equipment the sooner it will need to be replaced and will lose resale value.

From the beginning of 2011 to the end of 2017 I averaged just under 67,000 miles per year. When I figure out my total costs for the year, I divide by the number of total miles I drove in that year. I include fixed costs and variable costs in that calculation, and that’s my break-even number per mile. That’s how I know how much income I need to be profitable.

My truck and van trailer are paid off, so the cost per year will go down the longer I keep the equipment. Unfortunately, my repair bills will continue to increase over time. It’s a trade-off. An accountant can tell you more about depreciation and all that, but I’m going to keep it simple and just divide all my costs by seven, for the number of years I’ve been in business so far.

Mileage Has a Big Impact on Variable Cost

I have an older truck and a new van trailer. I’m buying a new truck this year, and I expect to get better mileage with the new rig. But I’m proud to say that I get almost 6.5 miles per gallon on my 2007 Volvo VNL 630.

Getting good mileage is incredibly important, since I already spend more than $35,000 per year on fuel. Over the past seven years, I spent $247,329 on 72,435 gallons of diesel, and I drove 468,657 miles. That’s an average of $3.41 per gallon, and at almost 53¢ per mile, it’s my biggest variable cost. If I got only 6 miles to the gallon instead of 6.5, fuel would cost me 58¢ per mile instead of 53¢.

Repairs to my truck and trailer cost me $179,295 over the years, which adds 38¢ per mile. That’s another big one. I expect to save some money on repairs once I get my new rig. Of course, my truck payment will be higher, and that’s a fixed cost, no matter how far I drive. Another trade-off.

Gotta Do the Math

The numbers I am sharing are based on real expenses from my company over the past seven years. I built a prediction of my operating costs for 2018, based on the first six years, and results are not much different than they were in the past. Some expense categories are based on today’s prices, but others are based on averages over the past seven years.

Cost Per Mile is $1.31, Not Including Driver Pay

Adding the fixed costs and the variable costs, plus the cost of repairs, gives me a cost per mile of $1.31, not including driver pay. I had a big repair bill last year, but I’m buying a new truck, so I don’t expect to spend as much on repairs next year. Then I added my expected fuel cost for the year, based on estimated miles. Some people add fuel to their variable costs, but I prefer to keep it separate. Based on my estimate of 67,000 miles for the year, I’ll have a base cost of $1.31 per mile to run my trucking business in 2018. That means I can be profitable at a pretty low rate per mile, but there are still a few things to consider.

Don’t Forget Leases, Taxes, Driver Pay, and Deadhead Miles

My equipment is paid off, but if you are making lease payments on your truck or trailer, you’ll add those under Fixed Cost. Other expenses that I did not list here include federal, state, and employee taxes. Most important of all is payroll for yourself. No one wants to work for free.

On top of $1.31 per mile for expenses, and money for my own compensation — call it “driver pay” — I also like to have a little cushion, so I do my best to keep my average rate above $2.00 per mile for all miles. That might not sound like a lot in today’s market, but remember that it includes deadhead. If I drive 10% deadhead miles, I need to get paid at least $2.20 per loaded mile to cover the unpaid portion.