If you’ve ever searched for freight on a DAT One load board, you’ve maybe noticed the average market rates that we show on every lane. Those prices are pulled into the load board directly from DAT RateView and are calcuted from a database of billions of dollars in freight transactions between brokers, carriers and shippers. How do we calculate those numbers?

DAT has established very rigorous processes to collect and analyze rate data, and I have been very involved in designing and maintaining those processes since DAT introduced RateView in 2010. While other companies claim to have the “best” rates, DAT rate data gives you the most accurate reflection of the marketplace — what carriers are actually being paid in every lane, by trailer type, in every season.

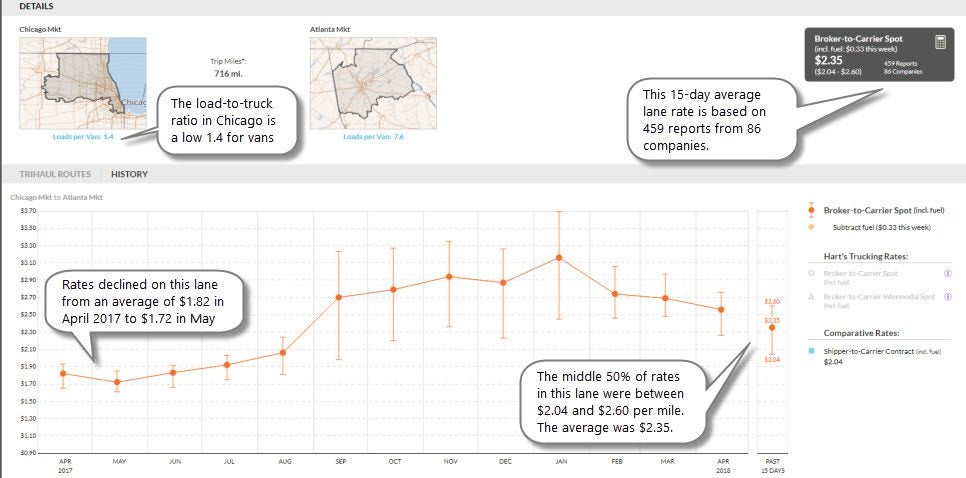

DAT rate data is open and transparent. In RateView, for example, each lane lookup includes information on the number of companies and the number of freight moves that made up that lane rate, so you can decide for yourself whether that is the right amount of information to support your own pricing decisions.

Where Do DAT Rates Come From?

Rate data is uploaded automatically, every day, directly from the contributors’ transportation management systems. Hundreds of brokers, carriers, and shippers contribute data, so they can compare their own rates to the aggregated data from all rate contributors. The data submission is automated, so contributors don’t pick and choose which rates to submit. DAT receives the data and validates it, to be sure that all the information is included.

For example, if the broker’s TMS captured the wrong destination, that would affect mileage for the route, causing an error in the rate per mile. DAT’s system checks for errors and outliers, and excludes errant data from the mix before constructing an average. Our database experts also work with customers to be sure that future rate submissions will conform to the correct format.

DAT systems mask the identity of rate contributors, to preserve their confidentiality. Each lane rate includes a minimum of three contributors, and no individual company dominates a lane rate as displayed in the system.

RateView is Supported by Decades of Experience as a Pricing Analyst

DAT rates are often used for benchmarking and decision support. You may not become an instant pricing expert by using RateView, but you’ll have a good starting point for negotiations. Over time, you will spot patterns that help you to get ahead of emerging trends.

After more than thirty years in freight transportation and logistics, plus academic training in math and statistics, as well as logistics, I’m 100% dedicated to making the DAT RateView product and database into the most reliable and robust source of freight rate data. I only wish this product had existed when I was a pricing analyst! Back then, I had to make big, expensive decisions based on experience and relationships, and I made it work. I was able to incorporate a lot of my experience and knowledge into RateView, along with some sophisticated mathematical formulae, and the result is a great tool set that gives you an edge in today’s dynamic market.

RateView Doesn’t Tell You What the Rates Should Be

The purpose of DAT freight rates is to help you understand what carriers have been paid in a particular lane, either in the past week, month, quarter or full year, depending on your needs. RateView does NOT tell you what you should charge or what you should pay. You can decide for yourself whether your pricing should conform to the averages, or whether that is just a starting point. For example, if you provide special services or you work with high-value cargo, you might take the average rate for standard van trailers and add a certain percentage to compensate for the extra service.

A carrier might provide value-added services, such as team drivers or tarps, that call for a price increase. Or anyone might look at the 13-month lane rate history in RateView, and see that a particular rate rose at this time last year. If the seasonal trend holds, you can expect to pay — or receive — a higher rate this week than the average in RateView, which is based on the recent past.

Separate Databases for Spot and Contract Markets

DAT maintains two separate databases: one is for spot market rates, which are typically one-time rates paid by freight brokers to carriers. Spot market rates are derived from rate agreements between the broker and the carrier, reflecting the broker’s “buy” rate. The second database is comprised of shipper-to-carrier contract rates, which come from many thousands of individual freight bills. DAT keeps these two databases separate, because the rates are negotiated differently, and the rate data serves a different purpose, for each group.

View Rates With or Without the Fuel Surcharge

Shipper-to-carrier contracts are often based on a line haul rate, and the fuel surcharge is separate. That’s because the surcharge varies with the cost of diesel, and that can change over the life of the contract.

Freight brokers typically quote a one-time rate, which includes the fuel surcharge. The broker might keep a record of the fuel surcharge component, but the quote to the carrier is usually for the total trip. DAT RateView lets you select whether to view rates with or without the surcharge, and you can choose to see the rate per mile or per trip. If you have your own way of handling the fuel surcharge, you can make adjustments using the calculators in RateView.

What Rates Are Displayed in DAT Load Boards?

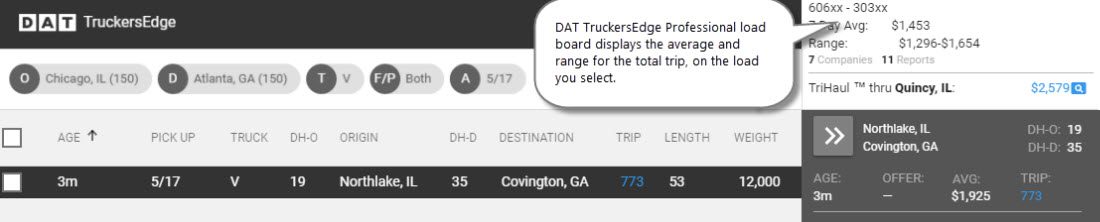

Many carriers and brokers will see DAT rate data integrated into the load board, even if they don’t have a separate subscription to DAT RateView. If you subscribe to DAT TruckersEdge Professional, for example, those rates will represent rolling, 15-day averages between two market areas — each market is defined as a cluster of 3-digit ZIP codes surrounding a metro area. DAT TruckersEdge Enhanced provides 90-day rolling averages between expanded markets, so if you want more information on dynamic, seasonal changes, you are better off with TruckersEdge Pro’s higher level of precision and smaller geographic areas surrounding the origin and destination markets.

In addition to rates and calculators, some DAT Power load board subscriptions include Hot Market Maps that display the outbound load-to-truck ratio by market, as well as other tools that can help you understand whether the lane is trending up or down right now. When you search for a load in most DAT load board products, the average rate will turn up in your search results, and in some cases, the load provider will also post an offer rate for that specific load.

DAT Hot Market Maps display the outbound load-to-truck ratio for the most recent business day, for each equipment type. Hot Market Maps are available in DAT RateView and in the DAT Power load board.

What Does the National Average Rate Mean?

DAT RateView provides a national average rate for dry van, refrigerated (“reefer”) and flatbed freight. These are rolling monthly averages, updated daily, for lanes of 250 miles or above. Basically, the national average is comprised of rates for over-the-road hauls, where it’s tough to complete a round trip in a single day.

DAT excludes short-haul and local rates from the national average. Short-haul freight typically pays more per mile, because the truck can’t run as many miles per day with multiple picks and drops. Carriers charge more to cover for that lost productivity.

When other companies publish their national average rates, they may not exclude short-haul rates, so their national average rates could be higher than what you’ll see on DAT. Each individual load doesn’t pay more, but those averages include more high-paying, short-haul loads. So don’t be fooled into thinking that you’ll find better-paying loads on a load board that touts a higher national average rate.

Generally, the national average can help you to understand whether your company’s average rates are in line with the market, and whether rates are trending up or down overall. The national average is not a precise benchmark for individual loads, because the origin-destination pair, the commodity, trailer type, and other factors are unique to each transaction.

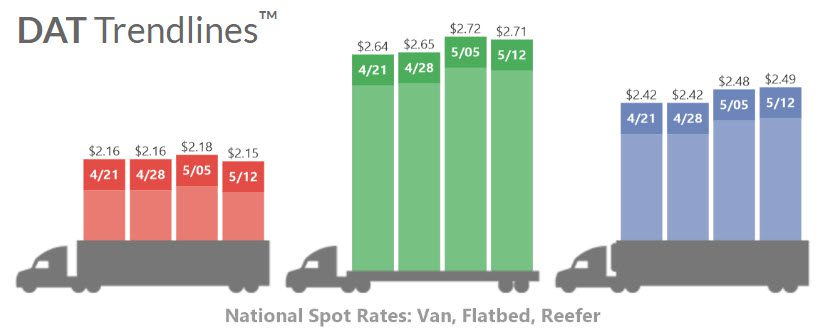

What Freight Rates Am I Seeing in DAT Trendlines?

National averages are published weekly in DAT Trendlines, a free information service. The weekly update captures the rolling month to-date. So, for example, in the graph below, the national rate published in Trendlines for the week of April 22 – 28 was a rolling average of rates recorded in RateView from April 1 through April 28. The following week, the rolling average re-started on Tuesday, May 1, so it included data from May 1 through 5.

If you’re looking for a longer-term overview, Trendlines also displays the national average rates by month, for each equipment type, in 13-month graphs at the bottom of the web page. You can use that to compare April 2018 to April 2017, for example. On those monthly graphs, you can also compare spot market rates to the contract rates that shippers pay directly to carriers.

DAT Trendlines displays a weekly snapshot of national average rates, which represents the rolling month to-date. The average that’s dated April 21 is the average for the month of April until that date — so it’s a 21-day average. The average dated May 12 is for the month of May until that date, so it’s a 12-day average. National average rates in Trendlines and in DAT RateView include lanes of 250 miles or more in the average. You can see rates in RateView for individual, short-haul lanes, but the national average rate is based only on 250-mile trips and longer.

Analyze freight rate trends and negotiate from strength, with DAT RateView, a truckload pricing database.