Since April when imports of machinery peaked, volumes in the Port of Baltimore are down 29% according to the latest July data from IHS Market. The Port of Baltimore is the number one Roll-on/Roll-off (Ro/Ro) port in the United States and handles the majority of the U.S. East coast market’s share of Ro/Ro cargo annually.

Baltimore’s proximity to the Midwest’s major farm and construction equipment manufacturers has helped it become the leading U.S. port for combines, tractors, hay balers and the importing of excavators and backhoes. It’s also a good barometer for flatbed and specialized freight demand.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

According to July’s report, import volume of machinery through the Port of Baltimore was down 12% but still up a healthy 60% compared to June 2020.

The number one import category for RoRo machinery is Construction Equipment. This category accounted for 55% of volume in July followed by Agricultural Tractors at 14% and Trucks at 13%.

Compared to July 2020, Construction Equipment volumes have doubled while the volume of Trucks and ForkLifts has almost tripled in the past 12-months. Carriers should note that import volumes typically taper off through year-end and have now been declining for three consecutive months.

The Baker Hughes Rig Count, an important business barometer for the drilling industry, passed the 500 mark last week with the number of active drilling rigs now up more than double in the last 12-months. Flatbed loads are up 72% month-over-month to the second largest oilfield in North America, known as the Bakken, located in North Dakota and Montana.

As a result, spot rates from Houston to Bismarck have also increased by $1.38/mile since the start of the year and are now averaging $3.23/mile. Loads west to El Paso from Houston increased by 6% last week. This makes it four straight weeks of volume gains. However, capacity eased for the first time in 12-months following a $0.38/mile decrease in spot rates to an average of $2.98/mile last week.

Spot rates

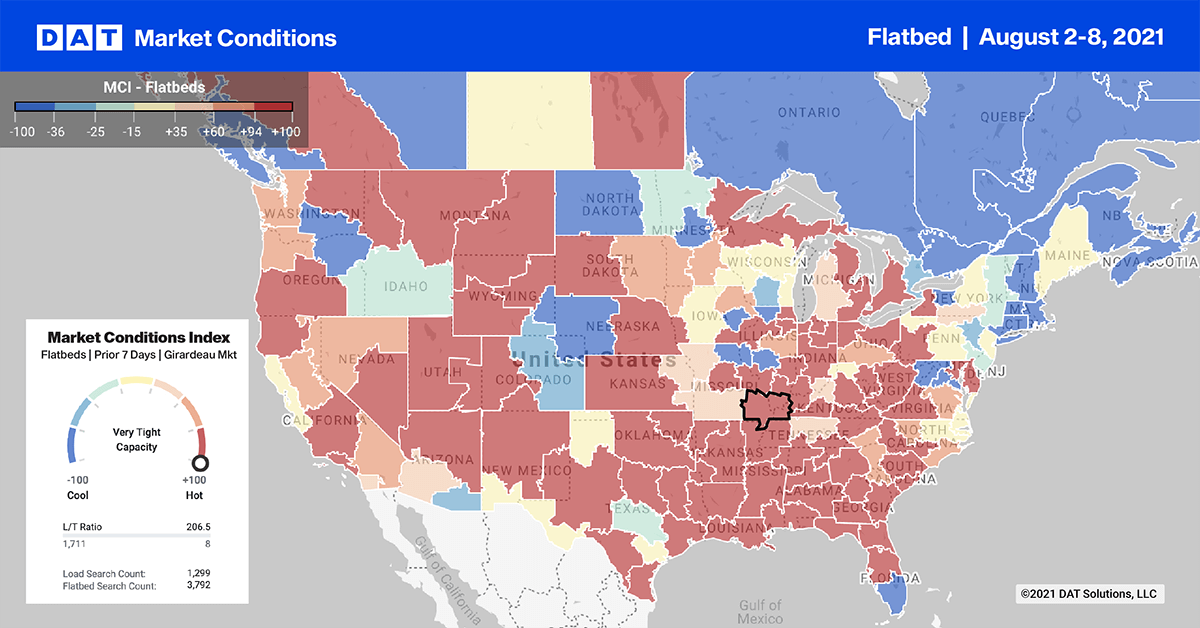

Even though flatbed spot rates dropped another penny per mile last week, they have been decreasing steadily over the last six weeks and are down $0.08/mile over that timeframe. Flatbed spot rates remain $0.59/mile higher than the same week last year and $0.19/mile higher than the same time in 2018.

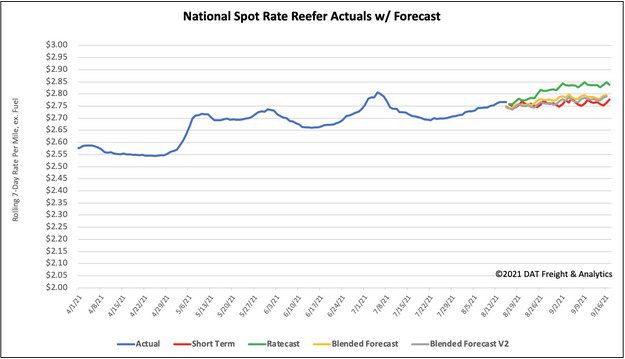

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models