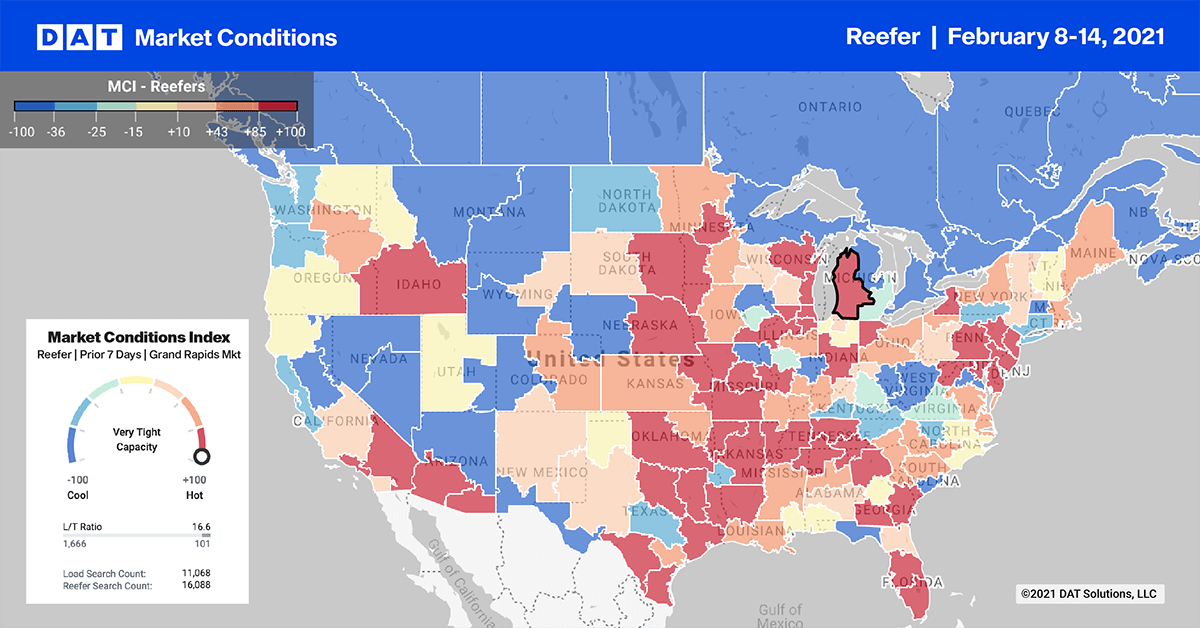

Late-season and long-lasting apples are shipping from the Grand Rapids, MI, market, where outbound capacity is tight this week. Spot rates on the lane to New York are averaging $4.44/mile.

Farther south in Philadelphia, reefer load posts are up 12% month over month, as imports of Peruvian table grapes arrive on break-bulk reefer vessels. Volumes from Peru are up this year in comparison to the average of the past five seasons, according to Capespan North America.

The latest import data from the USDA indicates 76% of this season’s grape import crop in January arrived in Philadelphia, 17% in Los Angeles and 4% in Savannah. Philadelphia has 100 million people within a 500-mile radius or a 1-day delivery window for carriers, with average outbound rates up $0.11/mile to $2.48/mile this week. High-end loads on the number four volume lane to Chicago are averaging $2.28/mile and as high as $2.73/mile this week after being on the rise since the start of October.

Find reefer loads and trucks on the largest on-demand freight marketplace in North America.

Reefer load posts decreased in six of the top 10 markets last week, with large increases in Chicago and Joliet, IL, keeping the average decrease to just under 2% w/w. Chicago and Joliet outbound volumes jumped by 37% and 19% w/w respectively – capacity was tight for reefers with rates increasing by $0.14/mile to $3.00/mile in Chicago and by $0.21/mile to $3.08/mile in Joliet.

Down south, the Miami market was hot ahead of Valentine’s Day, as shippers raced to deliver fresh-cut flower around the country. Even though outbound Miami load posts were down 26% w/w as the red rose shipping season wound down, capacity was very tight, with spot rates spiking $0.38/mile to $2.53/mile on average to all destinations. Valentine’s Day flower volumes drove up spot rates by $0.38/mile to an average of $2.04/mile last week. Miami to Boston loads were higher at $2.63/mile. Loads to Baltimore were paying an average of $2.50/mile and as high as $3.41/mile, and on the 452-mile run to Atlanta reefer rates were also higher at $2.18/mile.

Spot rates

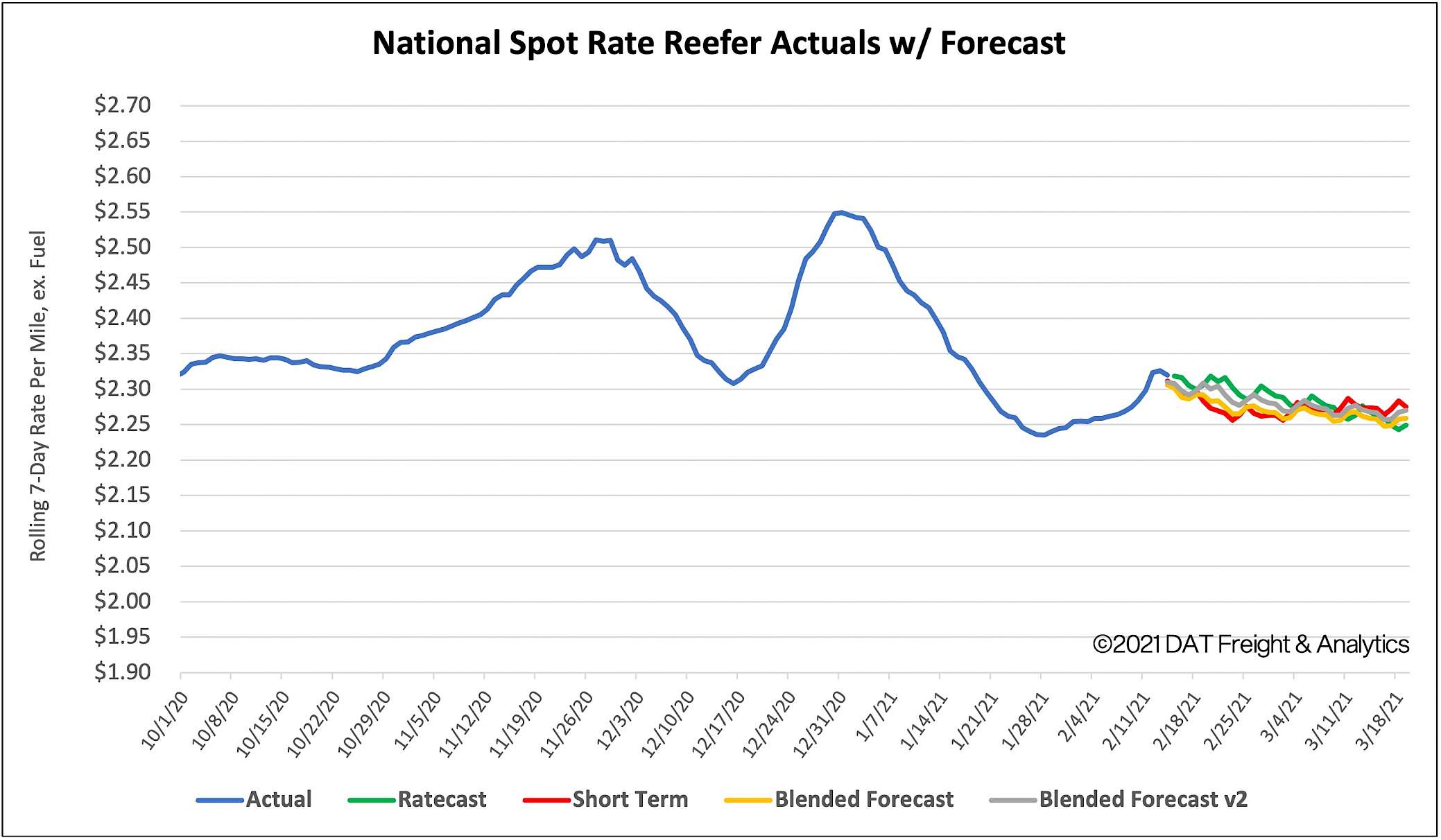

Spot rates in the reefer sector surged last week, increasing by $0.06/mile to reach $2.33/mile. Reefer spot rates are now 22% higher or $0.51/mile higher than the same week in 2020.

How to interpret the rate forecast

1. Ratecast Prediction: DAT’s core forecasting model estimate showing continued optimism and rate growth.

2. Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

3. Blended Scenario: More heavily weighted towards the longer-term models.

4. Blended Scenario v2: More heavily weighted towards the shorter-term models.

> Learn more about Ratecast predictions available in RateView.