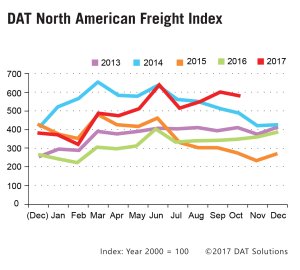

PORTLAND, Ore. — The October DAT North American Freight Index continued a 17-month streak of year-over-year increases in load availability, driving spot market rates to new heights for all equipment types. Volume soared 65 percent higher than October 2016, but dipped 3 percent compared to September, according to DAT Solutions, which operates North America’s largest digital truckload freight marketplace.

October is typically a high point for contract freight associated with holiday retail. This year, that included a surge of port traffic on both coasts. That demand was compounded by ongoing recovery and rebuilding after third-quarter hurricanes, and the extra pressure on truckload capacity led to an increasing shift of freight to the spot market.

October is typically a high point for contract freight associated with holiday retail. This year, that included a surge of port traffic on both coasts. That demand was compounded by ongoing recovery and rebuilding after third-quarter hurricanes, and the extra pressure on truckload capacity led to an increasing shift of freight to the spot market.

“Early November results, coupled with trends in recent years, indicate that spot freight volume and rates are likely to rise again before the end of December,” according to Mark Montague, senior industry analyst at DAT.

For van trailers, October’s freight availability increased 66 percent year over year, even after an 8 percent seasonal decline, compared to September. The additional demand boosted the national average spot van rate by 5 cents to $2.02 per mile, including fuel, setting a three-year record that was 37 cents (22 percent) higher than the average for October 2016.

Demand for refrigerated (“reefer”) capacity followed the trend for vans, with a year-over-year increase of 68 percent coupled with a 5 percent decline compared to September. The national average reefer rate rose to $2.31 per mile, the highest monthly rate since December 2014. The line haul portion of the rate (sans fuel) was the highest since 2010, when DAT began publishing spot market rates. Reefer rates continued to climb in the first week of November, due to demand for fresh and frozen foods for Thanksgiving and Christmas.

Seasonal trends differed for flatbed demand, which increased 5 percent compared to September. The expansion was driven by ongoing post-hurricane recovery and rebuilding in Texas and Florida. With a 105-percent increase year over year, flatbed freight availability achieved the highest-ever level for the month of October. The national average rate was up 5 cents to $2.33 per mile, a 41-cent increase compared to October 2016. Flatbed rates typically decline seasonally in the winter, and rates already began to slip lower in the first week of November.

Established in 1978, DAT operates a network of load boards serving intermediaries and carriers across North America. For more than a decade DAT has published its Freight Index, which is representative of the dynamic spot market.

Reference rates are the averages, by equipment type, based on $33 billion of actual transactions between freight brokers and carriers, as recorded in DAT RateView. Reference rates per mile include fuel surcharges, except where noted, but not accessorials or other fees. Beginning in January 2015, the DAT Freight Index was rebased so that 100 on the Index represents the average monthly volume in the year 2000. Additional trends and analysis are available at DAT Trendlines.