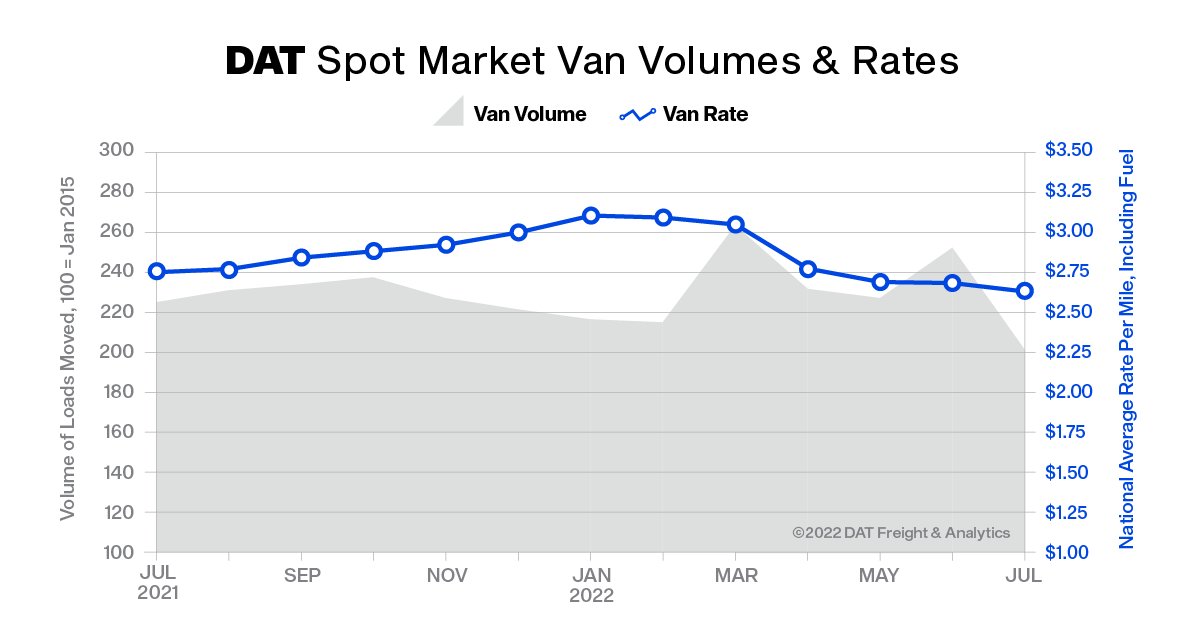

DENVER, Colo., August 29, 2022—Truckload freight volumes tumbled from their June peak and pricing for dry van and refrigerated capacity on the spot market continued to shift downward, said DAT Freight & Analytics, operators of the DAT One truckload freight network and DAT iQ data analytics service.

“Demand for van and reefer services softened predictably in July and freight volumes generally settled to levels seen in July 2020 and 2019. After several years of volatility, truckload volumes for van and reefer freight followed a more typical summertime pattern,” said Ken Adamo, DAT Chief of Analytics.

DAT’s July Truckload Volume Index (TVI) for dry van freight was 201, down 20% compared to June. The TVI for reefer freight was 133, down 12.5%, and the flatbed TVI was 217, down 15.9% month over month. “While the number of flatbed loads moved was strong relative to previous years, the volume decline from May through July was steeper than expected,” Adamo said.

Year over year, the van TVI was down 17% and equal to July 2020. The reefer TVI was 7.1% lower compared to July 2021 and 1.9% less than July 2020. The flatbed TVI was 13.6% higher than July 2021 and up 16% compared to July 2020.

Changes in the TVI reflect the number of loads moved with a pickup date during last month.

Spot, contract rates declined

After gaining $1.15 since July 2020, the national average rate to move van freight under contract crested and fell to $3.21 per mile, down 8 cents compared to June. The contract rate for reefers fell 6 cents to $3.50 a mile and the flatbed rate dropped 8 cents to $3.83 a mile.

The national average rate for spot van freight was $2.63 per mile, down 5 cents compared to June. The spot reefer rate was $2.99 per mile, down 6 cents and below $3 for the first time since April 2021. The flatbed rate averaged $3.29 per mile, a 17-cent decrease month over month. Spot rates are negotiated by the carrier and freight broker as one-time transactions.

Spot load posts fell 26%

The total number of loads posted to the DAT One load board network fell 26% compared to June and fell 34% year over year. The number of trucks on the network fell 9.3% month over month but was 8.1% higher compared to July 2021.

The national average van load-to-truck ratio fell from 3.9 in June to 3.8, meaning there were 3.8 available loads for every van on the DAT network. The reefer load-to-truck ratio was 7.2, up from 7.0. The flatbed ratio declined sharply for the second straight month, falling from 63.3 in May to 37.6 in June to 21.8 in July.

Fuel price relief

The national average retail price of fuel was $5.48 per gallon in July, 27 cents less than June, according to the U.S. Energy Information Agency. Fuel surcharges averaged 71 cents a mile for van freight, 77 cents a mile for reefers and 85 cents a mile for flatbed freight; all three were down nearly 5 cents from record highs in June.

For more information about DAT iQ, go to dat.com/iQ.

About the DAT Truckload Volume Index

The DAT Truckload Volume Index is produced by DAT iQ and reflects the change in the number of van, refrigerated and flatbed loads moved under contract and the spot market with a pickup date during that month. Index numbers are normalized each month to accommodate any new data sources without distortion. Baseline of 100 equals the number of loads moved in January 2015.

Rates are derived from RateView, DAT’s database of $137 billion in annualized freight transactions for loads moved, not the “asking price” posted to the load board, on over-the-road lanes with lengths of haul of 250 miles or more. Spot rates represent the payments made to carriers by freight brokers, third-party logistics providers and other transportation buyers. Contract rates are paid by the shipper to the carrier.