Get your

Authority

Get your

Authority

Start your

Brokerage

Start your

Brokerage

Optimize your Business

Optimize your Business

Got Authority?

Call today to talk to sales - 800.551.8847

Build your brokerage business

Run under your own MC number

We’ll take care of all the paperwork

Get the right permitting

Get help throughout the whole process, even after you’re up and running

Avoid delays

Let the experts take care of the legal stuff so you don’t have to deal with delays

Broker Resources

Start your own broker success story with DAT

Peter Coratola Jr. founded EASE Logistics in a borrowed office after losing his job. Now, they’ve got hundreds of employees across the world. EASE Logistics grew its brokerage, in part, because of leadership that sought out beneficial partnerships. That’s where DAT Freight & Analytics came in.

Case Study: How Kingsgate reimagines logistics with DAT One automation

Kingsgate partnered with DAT Freight & Analytics to fully automate the load-tendering process for their motor carrier network. Using the Book Now tools within the DAT One platform, Kingsgate uncovered new efficiencies, new opportunities and set new land speed records.

Find Trucks and Cover Loads Faster

Get access to the largest carrier network in North America, plus the tools to book, qualify and onboard in minutes.

Load Board and Beyond

Move more freight with access to over 1.1 million trucks on the DAT One Load Board network, plus tools to maximize your private network of carriers.

Expand your reach

Automated booking / negotiation tools

Qualify Carriers Rapidly

Find the Plan That's Best for You

DAT One

Express

Reviews

Perfect for new brokers: Get access to North America’s largest truck marketplace

Most Popular

DAT One

Select Broker

Searches

Tools for growing businesses: Onboard, vet, monitor, and expand your existing carrier network.<.span>

DAT One

Office Broker

Certificates

Enterprise brokerages can make informed decisions and grow profits with streamlined operations and intelligence.

See the average broker spot market rates for the lanes you're searching. *DAT One Express plan includes 30 day rate Powered by DAT iQ, DAT One Select & Office plans include Market Rate Powered by DAT iQ spot market + contract.

Access the full North American load board network.

Unlimited Search & Post

Research new or current companies you are working with, including reviews from your peers.

Setup multiple truck searches and filter your results by the info you care about.

Supply-and-demand metric that provides the clearest view of where the freight markets are and forecasts where they’re headed with historical trends, normalized post and search behavior and accounted for outbound volume.

Post your loads via FTP or connect with a pre-approved TMS.

Access MC authority, safety ratings, insurance rates and more.

Find carriers who are searching for loads in your lanes.

Block companies you don’t want to work with and see results from the companies you prefer.

Help manage your team’s load and truck postings.

Check MC authority, safety ratings, insurance status, and more. DAT CarrierWatch includes insurance certificates.

Ready to simplify your operations?

Get the Transportation Management System built specifically for freight brokers and 3PLs.

Broker TMS

Expand your operations without growing your back office. Operations and accounting integrated into one system that expands with your business.

Simplify your accounting

Eliminate paperwork

Analyze your operations

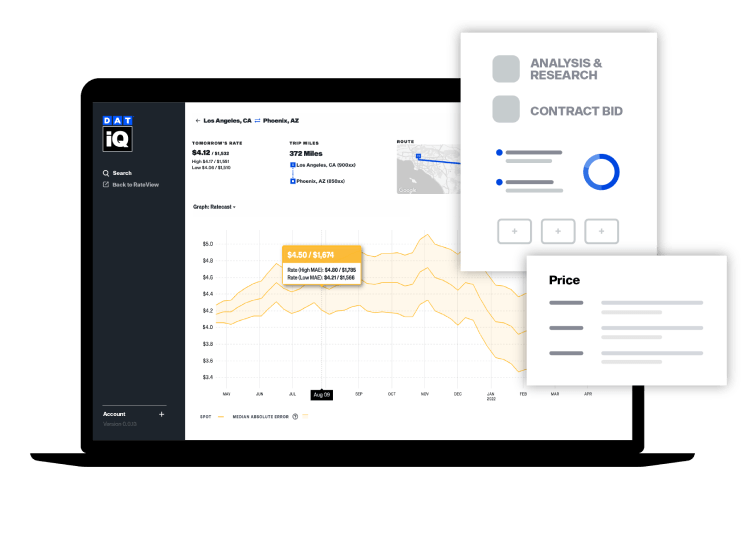

Looking for the most current freight rates?

Take advantage of the most comprehensive database of past, present, and future truckload rates to help you price shipments competitively.

Market Insights

DAT iQ can help you quote customers instantly with the most up-to-date market rates on every lane for any trailer.

Compare spot vs. contract rates

Protect your margins

Research new lanes

Are you bidding on RFPs?

Get the insights needed to win new business from shippers.

Get on the routing guide

We provide the most accurate freight rate predictive models so that you can bid on freight with confidence and win business that boosts your bottom line.

Anticipate market shifts

Forecast up to 1 year out

Assess your bid strategy

What our customers are saying

“We really use DAT every day to post loads, find carriers, track loads and bids. Whenever I have a problem, it's really easy to get it answered.”

-Bailey Dillenburg, T-Brothers

Need more tools?

We have even more solutions for brokers, including carrier qualifying and onboarding, load tracking, broker bonds and more.

Need resources? We got you covered.

We have been in the industry since 1978 to bring you the most knowledge and insight to help you find your path.